Loading

Get Rtso1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rtso1 online

Filling out the Rtso1 form can seem daunting, but with clear guidance, you can complete it effectively. This guide will walk you through each section of the form to ensure you submit accurate information.

Follow the steps to complete your Rtso1 form online.

- Press the ‘Get Form’ button to obtain the Rtso1 form and access it in your preferred editor.

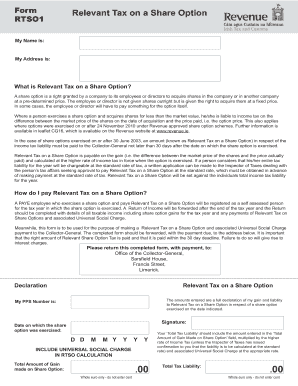

- Begin by entering your name in the designated field labeled 'My Name is:'. Ensure that you provide your full legal name.

- Next, fill in the 'My Address is:' section with your current residential address. Include all necessary components such as street name, number, city, and postal code.

- In the section titled 'Date on which the share option was exercised:', enter the date using the format DD/MM/YYYY. This date is crucial for calculating your tax obligations.

- Input the total amount of gain made on the share option in the 'Total Amount of Gain made on Share Option:' field. This should be a whole euro amount, without cents.

- Calculate your 'Total Tax Liability' by multiplying the total gain by the higher rate of income tax applicable at the time of exercise. Include the associated Universal Social Charge at the correct rate, and enter the total amount in the relevant field.

- Make sure to enter your PPS number in the designated field to uniquely identify your tax record.

- Complete the declaration section by signing and dating the form. This declaration affirms that all information provided is accurate and complete.

- Finally, review all entries for accuracy. Once confirmed, you can save changes, download, print, or share the completed Rtso1 form as needed.

Complete your Rtso1 form online today to meet your tax obligations.

To acquire ESOP shares, check with your employer's human resources or benefits department as they administer the Employee Stock Ownership Plan. They will provide guidance on eligibility and any required documentation. Understanding the benefits of ESOP alongside RTSO can significantly impact your financial future.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.