Loading

Get Ca Ftb Schedule Ca (540) 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB Schedule CA (540) online

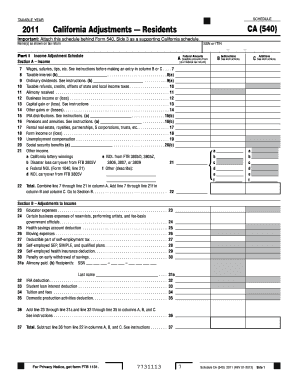

Filling out the CA FTB Schedule CA (540) online is an essential step for California residents when preparing their state tax returns. This guide provides a clear and supportive approach to help users navigate each section and field of the form efficiently.

Follow the steps to complete your CA FTB Schedule CA (540) online.

- Press the ‘Get Form’ button to acquire the form and open it in your chosen document editor.

- Begin by entering your name(s) as shown on your tax return and your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). This information is crucial for identity verification.

- In Part I, Section A – Income, record the federally recognized amounts in Column A. For each income source listed (e.g., wages, taxable interest, dividends), include the corresponding amounts from your federal tax return.

- For Column B, make any necessary subtractions from the federal amounts, adhering to the provided instructions for each income type.

- Continue through the various lines by noting any additional sources of income or losses (e.g., business income, capital gains, etc.) and filling in the corresponding columns.

- After completing Section A, calculate the total income in line 22 by adding all entries in Columns A, B, and C.

- Move to Section B – Adjustments to Income, where you will enter any qualified adjustments such as educator expenses, moving expenses, or health savings accounts.

- Follow the instructions carefully for lines 36 and 37, which require you to total the adjustments and subtract them from the total income calculated earlier.

- In Part II, record any adjustments to federal itemized deductions. Ensure accuracy in your entries to reflect proper state adjustments.

- Once all sections are filled out, review your form for accuracy before proceeding to save your changes, download, print, or share the completed Schedule CA (540).

Complete your CA FTB Schedule CA (540) online today for accurate and efficient tax filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You should file your 540 ES forms with the California Franchise Tax Board. The forms can be mailed to the address provided in the instructions or submitted electronically if applicable. For proper guidance, check with reliable tax services or the CA FTB website.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.