Loading

Get Wi Dor S-211 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR S-211 online

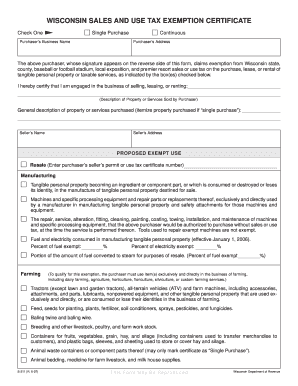

The WI DoR S-211 form serves as a Wisconsin sales and use tax exemption certificate. This guide provides clear, step-by-step instructions on how to effectively fill out the form online, ensuring you understand each section and its requirements.

Follow the steps to fill out the WI DoR S-211 form online:

- Press the ‘Get Form’ button to retrieve the form and open it in your preferred editing tool.

- Select the appropriate checkbox for the type of purchase: Single purchase or Continuous, indicating whether the exemption is for a one-time transaction or ongoing.

- Enter the purchaser's business name and address in the designated fields, providing clear and accurate information.

- In the description section, specify the type of property or services being sold, leased, or rented. Provide detailed information for clarity.

- Fill in the seller's name and address accurately to facilitate proper documentation.

- Indicate the proposed exempt use by checking the relevant boxes, such as Resale, Manufacturing, or Farming, and provide additional required numbers where necessary.

- If claiming exemptions for fuel and electricity consumed in manufacturing or farming, fill in the respective percentage fields.

- For governmental units, ensure to check the appropriate box and enter the Certificate of Exempt Status (CES) number if applicable.

- Review the 'Other' section to claim any additional exempted items or services as specified in the instructions.

- Sign the form where indicated, printing or typing your name and title, along with the date of completion to validate the certificate.

- Save your changes, and then download, print, or share the form as required based on your needs.

Complete your Wisconsin sales and use tax exemption certificate online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To be classified as a tax-exempt individual in Wisconsin, you generally must meet the standards set forth in WI DoR S-211. This usually involves being a qualifying non-profit or meeting specific criteria related to disability or age. Assessing your qualifications carefully can lead to significant financial benefits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.