Get Vt Dot S-3 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

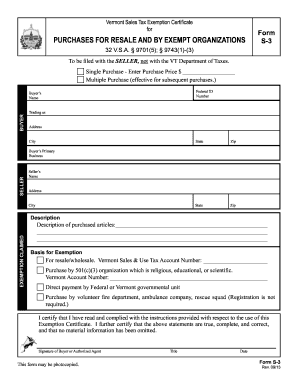

Tips on how to fill out, edit and sign VT DoT S-3 online

How to fill out and sign VT DoT S-3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Tax form completion can pose a significant difficulty and a major headache if no suitable support is offered.

US Legal Forms has been created as an online solution for VT DoT S-3 electronic filing and provides numerous benefits for the taxpayers.

Use US Legal Forms to ensure a convenient and straightforward VT DoT S-3 completion.

Locate the form on the site in the designated section or by using the Search feature.

Hit the orange button to launch it and wait until it's finished.

Review the form and adhere to the guidelines. If you have not filled out the template before, follow the line-by-line directions.

Pay attention to the highlighted fields. These are editable and require specific information to be entered. If you're unsure what to input, review the instructions.

Always sign the VT DoT S-3. Utilize the integrated tool to create the electronic signature.

Select the date field to automatically insert the correct date.

Reread the form to verify and modify it before submission.

Click the Done button in the top menu once you have completed it.

Save, download, or export the finished form.

How to modify Get VT DoT S-3 2003: personalize forms online

Utilize our sophisticated editor to convert a basic online template into a finalized document. Continue reading to discover how to adjust Get VT DoT S-3 2003 online effortlessly.

Once you locate an optimal Get VT DoT S-3 2003, all you need to do is modify the template to suit your preferences or legal stipulations. In addition to filling out the editable form with precise information, you may need to eliminate certain clauses in the document that are not pertinent to your situation. Conversely, you may wish to insert any additional terms that are absent from the original template. Our cutting-edge document editing capabilities are the ideal method to amend and tailor the form.

The editor enables you to alter the content of any form, even if the file is a PDF. You can add and delete text, insert fillable fields, and implement further modifications while maintaining the original formatting of the document. It is also possible to reorganize the layout of the form by adjusting the page sequence.

There’s no need to print the Get VT DoT S-3 2003 to sign it. The editor includes electronic signature features. Most of the forms already incorporate signature fields. Therefore, you merely need to append your signature and request one from the other signing individual with just a few clicks.

Adhere to this step-by-step manual to generate your Get VT DoT S-3 2003:

Once all parties have signed the document, you will obtain a signed copy which you can download, print, and distribute to others.

Our services help you save a significant amount of time and reduce the likelihood of errors in your documents. Optimize your document workflows with efficient editing tools and a robust electronic signature solution.

- Access the selected template.

- Utilize the toolbar to modify the template to your liking.

- Fill out the form with accurate details.

- Click on the signature field and insert your electronic signature.

- Transmit the document for signature to additional signers if necessary.

Get form

Related links form

To find the span number in Vermont, you can typically access local property assessment records or land records. Alternatively, the Vermont Agency of Natural Resources provides tools to search for such numbers. For clarity and assistance related to VT DoT S-3 and property documentation, utilizing resources like US Legal Forms can be advantageous.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.