Loading

Get Va Dot R-5e 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT R-5E online

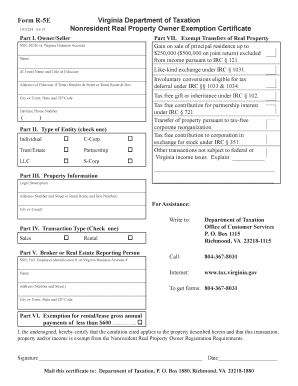

The VA DoT R-5E form is an essential document for nonresident real property owners seeking exemption from certain tax obligations in Virginia. This guide will provide step-by-step instructions on how to effectively fill out the form online.

Follow the steps to complete your VA DoT R-5E form effortlessly.

- Click ‘Get Form’ button to access the VA DoT R-5E and open it in your preferred online editor.

- In Part I, provide the owner or seller's details by entering their SSN, FEIN, or Virginia Business Account number, alongside their name. If the owner is a trust, include the name and title of the fiduciary, along with their address.

- Indicate the type of exemption applicable in Part II by checking the box corresponding to the entity type: Individual, C-Corp, Trust/Estate, Partnership, LLC, or S-Corp. If other, provide an explanation.

- In Part III, fill out the property information. This includes the legal description of the property and its address, ensuring accuracy to prevent delays.

- Select the transaction type in Part IV by checking either the Sales or Rental option based on the nature of the transaction.

- Complete Part V by providing the broker or real estate reporting person’s identification number and their location details.

- In Part VI, check the exemption for rental or lease gross annual payments of less than $600, if applicable.

- Affirm the details by signing and dating the form at the bottom. This certifies the information provided signifies that the transaction is exempt.

- Once you have filled in all sections accurately, save the changes made to the document. You can then download, print, or share your completed form as necessary.

Complete your VA DoT R-5E form online today to ensure timely processing and compliance with tax regulations.

Related links form

The VA code 58.1 3017 focuses on the assessment and collection of local taxes in Virginia. It outlines the processes through which local jurisdictions can manage tax collection effectively. Knowing how the VA DoT R-5E intersects with this code can help you understand local tax obligations and compliance strategies, supporting your financial planning.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.