Loading

Get Ny Dtf It-603 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-603 online

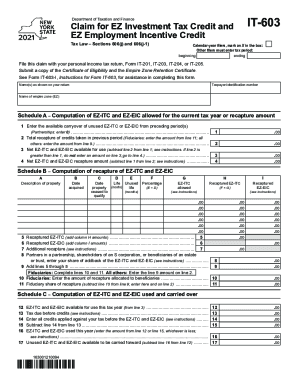

The NY DTF IT-603 form is essential for individuals claiming the EZ Investment Tax Credit and the EZ Employment Incentive Credit. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the NY DTF IT-603 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as it appears on your tax return in the designated field.

- Input your taxpayer identification number in the corresponding area.

- Specify the name of the empire zone in the provided field.

- Complete Schedule A by entering the available carryover of unused EZ-ITC or EZ-EIC from preceding periods.

- Calculate the total recapture of credits taken in previous periods and enter the amount in the provided space.

- Determine the net EZ-ITC and EZ-EIC available for use by subtracting the previously calculated amount from the carryover amount.

- Calculate the net EZ-ITC and EZ-EIC recapture amount by subtracting the carryover from the total recapture.

- Proceed to Schedule B and fill in the description of property, acquisition date, and relevant calculations for recapture as instructed.

- Complete Schedule C by entering the amounts from previous calculations, including the EZ-ITC and EZ-EIC available for use this tax year.

- Review all entries for accuracy before saving your changes. You can then download, print, or share the completed form.

Start filling out your NY DTF IT-603 online today to ensure proper tax credit claims.

Key Takeaways. Form 1040 is the standard tax return form that most individual taxpayers use every year. The IRS no longer accepts Forms 1040-EZ or Form 1040-A for tax years 2018 and beyond, which means most taxpayers must use Form 1040 to complete their tax returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.