Loading

Get Ny It-203-tm-att-b 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-203-TM-ATT-B online

Filling out the NY IT-203-TM-ATT-B online can simplify your filing process and ensure accuracy. This guide will walk you through each step to help you complete the form effectively and efficiently.

Follow the steps to accurately complete your form online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Begin by entering the special NY State identification number and the legal name of your team at the top of the form.

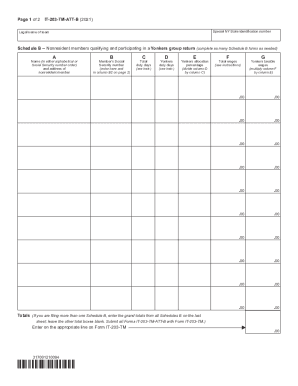

- Locate Schedule B, which is used for detailing nonresident members qualifying and participating in a Yonkers group return. You may need to complete multiple Schedule B forms depending on the number of members.

- In Section A, list the name and address of each nonresident member in either alphabetical or Social Security number order. Fill in the respective Social Security number in the next column.

- Proceed to enter the total Yonkers duty days for each member in Column C and the Yonkers allocation percentage in Column D as per the provided instructions.

- Next, calculate and enter the total wages for each member in Column F and multiply by the respective allocation percentage to determine Yonkers taxable wages in Column G.

- If completing multiple Schedule B forms, ensure to total all calculations at the bottom of each Schedule B by entering the grand totals from all forms.

- Once all data is accurately filled in, review the entire form for any errors or omissions. After confirming the information, you can save your changes, download the form, print it, or share as needed.

Complete your NY IT-203-TM-ATT-B online now for a streamlined filing experience.

Who must file the 1127 tax return? Any New York City employee who was a nonresident of the City (the five NYC boroughs) during any part of a particular tax year must file an 1127 return. In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.