Loading

Get Va Dot R-3 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT R-3 online

The VA DoT R-3 form is essential for individuals and businesses wishing to update their registration information with the Virginia Department of Taxation. This guide provides clear instructions on how to complete the form online, ensuring a smooth and efficient experience.

Follow the steps to accurately complete the VA DoT R-3 form online.

- Press the ‘Get Form’ button to obtain the R-3 form and open it in your preferred digital editor.

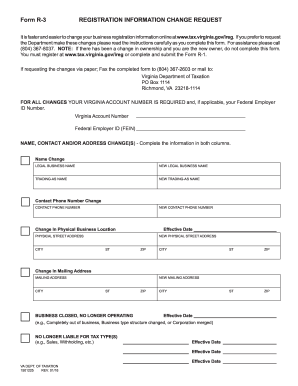

- Enter your Virginia Account Number and, if applicable, your Federal Employer ID Number at the top of the form. This is required for all changes.

- For name changes, input the current legal business name and the new legal business name in the designated columns. Also, provide the trading-as name and its new version if applicable.

- Update your contact information by filling in your current contact phone number and your new contact phone number.

- If you are changing your physical business location, fill out the effective date and both the current and new physical street addresses, including the city, state, and ZIP code.

- If there is a change in your mailing address, enter the current mailing address along with the new mailing address, including city, state, and ZIP code.

- If your business has closed or is no longer operating, indicate this in the provided section, and add the effective date of closure.

- List any tax types for which you are no longer liable, including the effective dates for these changes.

- Once all the fields are filled out correctly, you can save your changes, download the completed form, print it, or share it as needed.

Take action now to update your registration information online effectively!

Related links form

To close your VA withholding account, you will need to submit a written request to the Virginia Department of Taxation. This request must include your account information, confirming the completion of the final forms, such as the VA DoT R-3. It’s vital to keep copies of all your submissions for your records. If you need assistance, consider using resources from uslegalforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.