Loading

Get Ny Dtf It-251 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-251 online

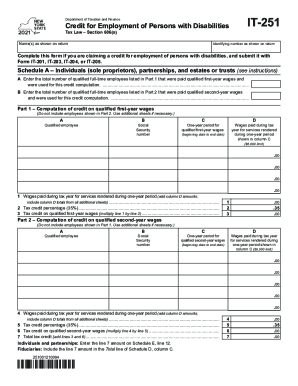

Filling out the NY DTF IT-251 form online is essential for claiming the credit for employment of persons with disabilities. This guide provides clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully fill out the NY DTF IT-251 online.

- Click ‘Get Form’ button to access the NY DTF IT-251 and open it in the editor.

- Begin by entering the name(s) as shown on your return in the designated field at the top of the form.

- Input your identifying number as shown on your return in the appropriate field.

- Indicate if you are claiming the credit for individuals, partnerships, or estates or trusts by selecting Schedule A.

- In Schedule A, enter the total number of qualified full-time employees paid qualified first-year wages in Part 1, Box A.

- For qualified second-year wages, list the total number of employees in Part 2, Box B.

- In Part 1, provide details for each qualified employee, including their Social Security number, the one-year period for qualified wages, and the wages paid during that period in Columns A, C, and D respectively.

- Calculate the total wages in Part 1 and apply the tax credit percentage of 35% to determine the tax credit on qualified first-year wages.

- Repeat the same process in Part 2 for qualified second-year wages, ensuring not to include employees already accounted for in Part 1.

- Aggregate your total tax credit at the end of Parts 1 and 2, and complete any applicable schedules for partnerships or fiduciaries.

- Once all information is accurately filled in, review your entries, then you have the options to save changes, download, print, or share the completed form.

Complete the NY DTF IT-251 online to ensure you can claim the available tax credits.

Related links form

The Child Tax Credit is worth a maximum of $2,000 per qualifying child. Up to $1,400 is refundable. To be eligible for the CTC, you must have earned more than $2,500.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.