Loading

Get Ny Dtf It-239 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-239 online

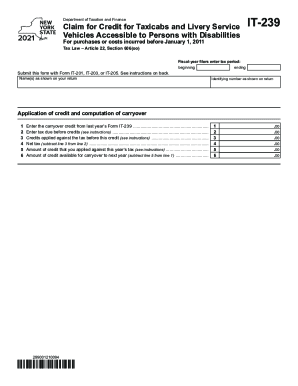

Filling out the NY DTF IT-239 form online is essential for claiming credits related to taxicabs and livery service vehicles accessible to people with disabilities. This guide will help you understand each component of the form and provide step-by-step instructions to ensure you complete it accurately.

Follow the steps to successfully complete the NY DTF IT-239 form online.

- Press the ‘Get Form’ button to access the form and open it for completion.

- Enter the names of all individuals as shown on your tax return in the designated field. Make sure the names match exactly.

- Input the identifying number as displayed on your return in the appropriate field.

- In the credit application section, begin by entering the carryover credit from last year’s Form IT-239 in line 1.

- Next, fill in line 2 with the tax due before applying any credits, based on your submitted tax form (IT-201, IT-203, or IT-205). Refer to the instructions specific to your form for accurate calculations.

- For line 3, list any credits you are applying against the tax before this credit as instructed.

- Calculate your net tax for line 4 by subtracting the amount on line 3 from the amount on line 2.

- On line 5, indicate the amount of credit that you are applying against this year’s tax, using lesser of the figures from line 1 or line 4.

- For line 6, calculate the amount of credit available for carryover to next year by subtracting the figure on line 5 from that on line 1.

- Once all fields are correctly filled, review your form for accuracy and completeness. You can then save your changes, download, print, or share the completed form as needed.

Complete your documents online to ensure a smooth filing process.

New York City school tax credit (rate reduction amount) You are entitled to this refundable credit if you: were a full-year or part-year New York City resident, cannot be claimed as a dependent on another taxpayer's federal income tax return, and. had New York City taxable income of $500,000 or less.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.