Loading

Get Va Dot Ast-3 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT AST-3 online

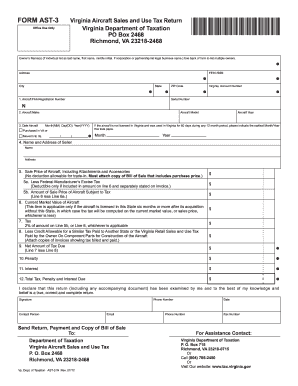

Completing the Virginia Aircraft Sales and Use Tax Return (VA DoT AST-3) is an important step for individuals and businesses involved in the sale or use of aircraft in Virginia. This guide will help you navigate the form with clear instructions for each section.

Follow the steps to successfully complete the VA DoT AST-3 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the owner’s name(s) in the designated field. If filing as an individual, input your last name, first name, and middle initial. For corporations or partnerships, provide the legal business name. Use the back of the form to list additional owners if needed.

- Fill in your address details, including street address, city, state, and ZIP code.

- Provide your Federal Employer Identification Number (FEIN) or Social Security Number (SSN).

- Input your Virginia Account Number, if applicable. Note that first-time filers will receive an account number after processing their return.

- Enter the aircraft FAA registration number and the serial number in the respective fields.

- Indicate the make and model of the aircraft along with the date of purchase or when the aircraft was moved into Virginia. Use the format Month (MM), Day (DD), Year (YYYY).

- Fill in the name and address of the seller. This should be the individual or entity from whom the aircraft was purchased.

- Enter the sale price of the aircraft, including all attachments and accessories. Attach a copy of the Bill of Sale showing the purchase price.

- Complete line 5a by entering the amount of any federal manufacturer's excise tax that is deductible, if applicable.

- Calculate the sale price of the aircraft subject to tax by subtracting the amount in line 5a from the sale price entered in line 5.

- If the aircraft is licensed in Virginia for more than six months after acquisition, enter the current market value of the aircraft on line 6. Otherwise, use the sale price.

- Calculate the tax, which is 2% of the amount from line 5b or line 6, whichever is applicable.

- If you have paid similar taxes to another state, enter the amount on line 8. This is the credit allowable for taxes previously paid.

- Determine the net amount of tax due by subtracting the amount on line 8 from the amount on line 7.

- Complete the sections for any applicable penalties and interest, if applicable, on lines 10 and 11.

- Sum the total tax, penalty, and interest due on line 12.

- Sign and date the return, and provide your contact information including phone number and email.

- Save your changes, download, print, or share the form as necessary.

Ensure your tax return is accurate and submitted on time by filing the VA DoT AST-3 online today.

Related links form

Filling out Form VA-4 requires you to provide accurate information about your tax status and choice of allowances. This form directly affects how much tax is withheld from your paychecks, so be sure to read the instructions carefully. For additional help and templates, the US Legal Forms platform offers user-friendly resources to ensure accurate completion.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.