Loading

Get Fiduciary Allocation It 205 A Department Of Taxation And ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fiduciary Allocation IT 205 A Department Of Taxation And Finance online

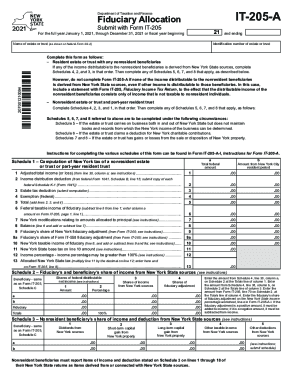

Filling out the Fiduciary Allocation IT 205 A form is a vital step for estates and trusts with nonresident beneficiaries. This guide will walk you through the process of completing the form online, ensuring you have the necessary information for a smooth submission.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to access the Fiduciary Allocation IT 205 A form and open it in your browser.

- Begin by entering the name of the estate or trust as it appears on the federal Form SS-4. This information is crucial for correct identification.

- Next, input the identification number of the estate or trust. Ensure this number matches what is listed on official documents.

- For estates or trusts without income from New York sources that is distributable to nonresident beneficiaries, you may skip this form and attach an explanatory statement to Form IT-205 instead.

- If you are filing for a nonresident estate or a part-year resident trust, ensure to complete Schedules 4, 2, 3, and 1 in that order, followed by other applicable schedules.

- Fill out Schedule 1 to compute the New York tax, following the specific lines provided for adjusted total income, deductions, and exemptions.

- Carefully complete the following schedules as required: Schedule 2 for income from New York State sources, Schedule 3 for nonresident beneficiary deductions, Schedule 5 for business income allocations, Schedule 6 for New York charitable deductions, and Schedules 7 and 8 for capital gains or losses.

- Finally, save your changes, and consider downloading or printing a copy for your records. You can then share the form as needed.

Start completing your Fiduciary Allocation IT 205 A form online today!

Related links form

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.