Loading

Get Isp 3520

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Isp 3520 online

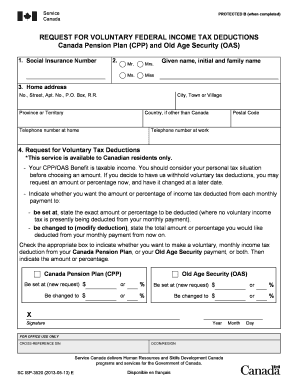

Filling out the Isp 3520 form for voluntary federal income tax deductions can be a straightforward process when guided correctly. This guide will provide you with clear, step-by-step instructions to assist you in completing the form online.

Follow the steps to fill out the Isp 3520 effectively

- Press the ‘Get Form’ button to access the Isp 3520 form and open it in your online editor.

- Enter your Social Insurance Number (SIN) in the designated field. Ensure that you input the correct number to avoid any issues.

- Select your title from the options provided (Mr., Mrs., Ms., Miss) and fill in your given name, initial, and family name.

- Provide your complete home address, including the street number, street name, apartment number (if applicable), city, province or territory, postal code, and a telephone number where you can be reached at home.

- If applicable, enter your work telephone number. This information aids in contact if necessary.

- Read the information regarding the voluntary tax deductions carefully. You can choose the amount or percentage of taxes to be deducted from either your Canada Pension Plan (CPP) or Old Age Security (OAS) payments.

- Indicate your preference for tax deductions: specify if you want to set a new amount or percentage of income tax deductions by filling in the respective fields.

- Select whether these deductions will be from your CPP, OAS, or both. Ensure the appropriate boxes are checked.

- Provide the date in the specific format requested (month, day, year) and sign the form at the designated section.

- Once the form is completed, you can save your changes, download a copy for your records, print it out if necessary, or share it as directed.

Start completing the Isp 3520 online today to manage your tax deductions effectively.

What Is the Income Tax Return Rate for 2021? Tax RateTaxable Income bracket12%$9,951 to $40,52522%$40,526 to $86,37524%$86,376 to $164,92532%$164,926 to $209,4253 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.