Loading

Get Printable New York Form It 256 Claim For Special Additional ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the printable New York Form IT 256 Claim for Special Additional Mortgage Recording Tax Credit online

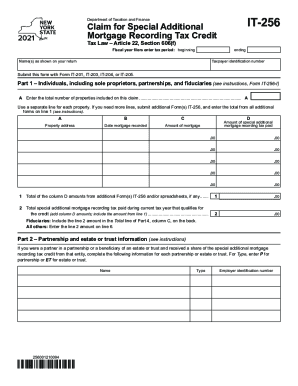

Filing the Printable New York Form IT 256 is essential for individuals and partnerships seeking a special additional mortgage recording tax credit. This guide provides clear instructions to help users efficiently complete the form online.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the form and open it in your preferred document editing tool.

- Enter your names as they appear on your tax return in the designated field. Ensure accuracy to avoid processing delays.

- Provide your taxpayer identification number in the relevant section. This number is essential for tax identification purposes.

- In Part 1, indicate the total number of properties related to your claim. Use a separate line for each property. For additional properties, submit additional Form IT-256 and sum their totals in the specified line.

- For each property, fill in the property address, the date the mortgage was recorded, and the amount of the mortgage. Take care to input accurate figures to prevent issues during processing.

- Document the amount of special additional mortgage recording tax you paid for each property. Add all amounts from the column D to find the total. Include this total in line 2 as applicable.

- Complete Part 2 if you are a partner in a partnership or a beneficiary of an estate or trust. Provide necessary identifying details for each entity.

- Proceed to Part 3 to enter your share of the credit received from any partnership or estate or trust, ensuring that you follow the instructions carefully.

- Move to Part 4 and fill in the details regarding your share of credits as required. This step is crucial if you are a fiduciary.

- In Part 5, compute the special additional mortgage recording tax credit available for the current tax year by following the prompts to add relevant lines.

- Finally, ensure to check all completed sections. Save your changes, and choose to download, print, or share the form as needed.

Start filling out your documents online today to take advantage of available tax credits!

Resident partners, members, or shareholders of flow-through entities may be allowed a New York State resident tax credit for pass-through entity taxes imposed by another state, local government within another state, or the District of Columbia, and paid by the flow-through entity on their behalf.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.