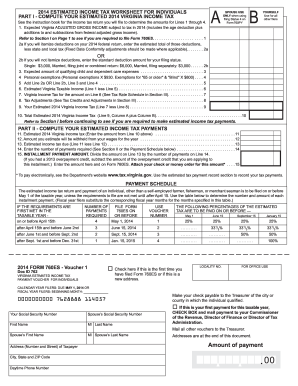

Get Va Dot 760es 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign VA DoT 760ES online

How to fill out and sign VA DoT 760ES online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Completing a tax form can turn into a major hurdle and significant frustration if there is no proper assistance provided.

US Legal Forms has been created as an online resource for VA DoT 760ES electronic filing and presents various benefits for taxpayers.

Press the Done button in the top menu once you have finished. Save, download, or export the completed template.

- Locate the form on the website in the appropriate section or through the Search function.

- Click the orange button to access it and wait for it to load.

- Examine the template and pay attention to the guidelines. If you haven’t filled out the template before, adhere to the step-by-step instructions.

- Concentrate on the highlighted fields. These are editable and require specific information to be entered. If you are unsure what information to provide, refer to the guidelines.

- Always sign the VA DoT 760ES. Use the built-in tool to create the electronic signature.

- Select the date field to automatically populate the correct date.

- Review the template to verify and modify it before the electronic filing.

How to modify Get VA DoT 760ES 2014: tailor forms online

Leverage the convenience of the feature-rich online editor while filling out your Get VA DoT 760ES 2014. Utilize the assortment of tools to swiftly complete the blanks and provide the necessary data immediately.

Preparing documents can be time-consuming and costly unless you have pre-made fillable forms to complete electronically. The simplest way to handle the Get VA DoT 760ES 2014 is to utilize our expert and multifunctional online editing tools. We offer you all the essential instruments for rapid form completion and allow you to implement any changes to your templates, tailoring them to any requirements. Additionally, you can make remarks on the modifications and leave notes for other parties involved.

Here’s what you can accomplish with your Get VA DoT 760ES 2014 in our editor:

Managing the Get VA DoT 760ES 2014 in our powerful online editor is the quickest and most effective way to handle, submit, and share your documents as desired from anywhere. The tool functions from the cloud so you can access it from any location on any internet-connected device. All templates you create or complete are securely stored in the cloud, allowing you to access them whenever needed, ensuring they are not lost. Stop squandering time on manual document completion and eliminate paper; accomplish it all online with minimal effort.

- Fill in the blank fields using Text, Cross, Check, Initials, Date, and Sign options.

- Emphasize vital information with a chosen color or underline them.

- Hide sensitive information using the Blackout tool or simply delete them.

- Insert images to illustrate your Get VA DoT 760ES 2014.

- Replace the original text with one that meets your needs.

- Add comments or sticky notes to collaborate with others about the modifications.

- Include extra fillable fields and allocate them to specific individuals.

- Secure the template with watermarks, insert dates, and bates numbers.

- Distribute the document in various formats and save it on your device or in the cloud as soon as you finish editing.

Get form

Related links form

You should file your VA form 760 with the Virginia Department of Taxation, either online or via mail. If you file electronically through platforms like US Legal Forms, it simplifies the process. Make sure to check the guidelines associated with the VA DoT 760ES for a successful submission.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.