Loading

Get Ut Tc-40 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-40 online

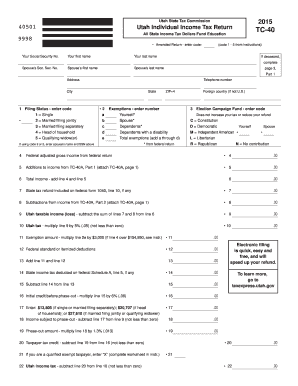

Filling out the UT TC-40 form is an essential step for individuals filing their Utah income tax returns. This guide provides a user-friendly approach to assist you in completing the form accurately and efficiently.

Follow the steps to fill out your UT TC-40 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Social Security number in the designated field. This ensures that the form is linked correctly to your tax records.

- Next, provide your first name and last name in the appropriate fields.

- If applicable, enter your spouse’s Social Security number along with their first and last names.

- Complete the address section with your current residential information, including city, state, and ZIP code.

- Choose your filing status by entering the appropriate code—from single to qualifying widow(er)—in the filing status section.

- Indicate the number of exemptions you are claiming, including yourself, your spouse, and any dependents.

- For the Election Campaign Fund, select the appropriate code to indicate your contribution choice.

- Input your federal adjusted gross income as shown on your federal return in the designated line.

- Add any additions to income as indicated on TC-40A, Part 1, by entering the necessary amounts.

- Calculate your total income by adding the previous two lines together.

- List any state tax refund included on your federal income tax return, if applicable.

- Enter any subtractions from your income as indicated on TC-40A, Part 2.

- Compute your Utah taxable income by subtracting the sums from the previous steps.

- Calculate your Utah tax by multiplying your taxable income by 5%.

- Determine any exemption amounts by multiplying your total exemptions by $3,000, if applicable.

- Enter Standard or Itemized deductions based on what you filed federally.

- Complete the necessary calculations for any credits and additional income tax adjustments.

- Evaluate your total tax due by subtracting any credits from your total tax calculation.

- If you are due a refund, report the amount. If you owe taxes, ensure the amount is clearly stated.

- For direct deposit, provide your routing number and account number for your refund.

- After reviewing all entries for correctness, save your changes, and proceed to download, print, or share the form as necessary.

Complete your UT TC-40 form online today for a faster filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Utah calculates state income tax based on a flat tax rate applied to your taxable income. The state provides detailed brackets and guidelines to help you prepare your tax return accurately. The UT TC-40 form includes essential elements for ensuring your tax calculations are correct. If you have questions about the process, the US Legal Forms website offers comprehensive resources to assist you.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.