Loading

Get Tx Form 50-129 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Form 50-129 online

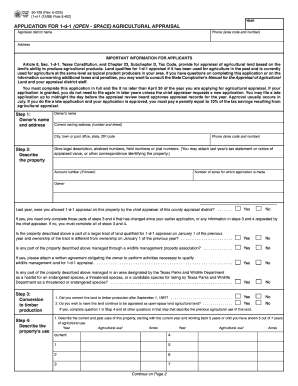

Filling out the TX Form 50-129 online can seem daunting, but with the right guidance, it can be a straightforward process. This form is essential for applying for 1-d-1 agricultural appraisal in Texas, and understanding each section is critical for a successful application.

Follow the steps to complete your application with ease:

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Enter the owner’s name and their current mailing address, including city, state, and ZIP code. Ensure that the information is accurate to prevent any delays in processing.

- Provide your phone number for any follow-up communications. Next, describe the property by including legal descriptions, abstract numbers, or any related documents that help identify the property. If known, enter the account number and specify the number of acres for which you are applying. Answer whether you were granted 1-d-1 appraisal last year, and if yes, only include information that has changed since your last application. If no, complete all sections as instructed.

- Continue with any relevant questions regarding the management or classification of the property. For example, if it has been converted to timber production, answer accordingly. Proceed to describe the current and past uses of the property over the last five years, indicating the type of agricultural use and the corresponding acreage.

- In the use section, specify all agricultural activities and any non-agricultural uses of the land. It is important to be thorough and accurate in this section to comply with appraisal requirements. List any existing governmental programs that apply to the property.

- Complete the final sections where you must sign the application, confirming that the information provided is true and correct. Remember that false information can result in legal consequences. Review the form for completeness before saving your changes.

- Once all sections are completed, you can save the changes, download a copy, print it, or share the form with required parties for submission.

Start filling out your TX Form 50-129 online today for a smoother application process!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Filling out the Texas two-step involves completing the required applications for tax exemption, including the TX Form 50-129, and submitting supporting documents. Start by gathering all necessary evidence of agricultural use and operational details. Ensure you submit within the deadlines set by your local taxing authorities to avoid complications.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.