Get Tx Comptroller 50-266 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-266 online

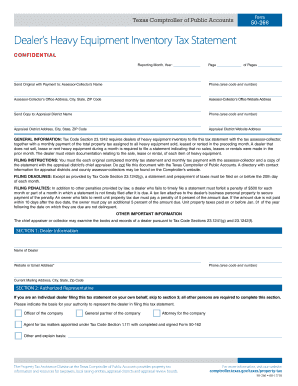

Filling out the TX Comptroller Form 50-266, the dealer's heavy equipment inventory tax statement, requires careful attention to detail to ensure compliance with tax regulations. This guide offers clear instructions for completing the form online, accommodating both seasoned dealers and those new to the process.

Follow the steps to complete the TX Comptroller 50-266 form online.

- Click the ‘Get Form’ button to access the TX Comptroller 50-266 form and open it in your preferred editor.

- Begin with SECTION 1: Dealer Information. Clearly provide the dealer's name, email address or website, and phone number along with the current mailing address including city, state, and ZIP code.

- If applicable, fill out SECTION 2: Authorized Representative. Only individuals other than the dealer should complete this section. Indicate the basis for authority and provide the representative's name, title, contact information, and address.

- Proceed to SECTION 3: Business Information. Here, input the name of the business, physical address, date the business opened, and the appraisal district account number, if available.

- In SECTION 4: Heavy Equipment Inventory Information, report the sale, lease, or rental of equipment for the reporting month. Provide details such as type of transaction, sales price or rental amount, unit property tax, and item descriptions.

- Complete SECTION 5 by breaking down the number of units sold, leased, or rented for the current month along with their transaction amounts, ensuring all figures are accurate.

- Finally, in SECTION 6: Dealer Statement and Signature, affirm the truthfulness of the provided information by signing the form and dating it.

- After completing the form, review all sections for accuracy. Save your changes, and prepare to download, print, or share the document as needed.

Complete your TX Comptroller 50-266 form online today to ensure timely and accurate filing.

Get form

Related links form

To request a certificate of no tax due, you must submit the appropriate form to the Texas Comptroller either online or via mail. This certificate verifies that you have no outstanding tax liabilities, which can be crucial for various applications. Taking advantage of USLegalForms can ensure that your request meets all requirements set by the TX Comptroller 50-266. Keeping your records organized will ease this process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.