Get Ca Ftb 592-v 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CA FTB 592-V online

How to fill out and sign CA FTB 592-V online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the tax period commenced unexpectedly or perhaps you just overlooked it, it could potentially cause issues for you. CA FTB 592-V is not the simplest form, but you shouldn't have any cause for concern regardless.

By utilizing our effective solution, you will discover how to complete CA FTB 592-V in scenarios of significant time shortages. You just need to adhere to these basic guidelines:

With this powerful digital solution and its expert tools, completing CA FTB 592-V becomes simpler. Don't hesitate to use it and allocate more time to hobbies and interests rather than document preparation.

Open the document using our sophisticated PDF editor.

Input all the necessary information in CA FTB 592-V, utilizing the fillable fields.

Incorporate images, crosses, checks, and text boxes, if required.

Repeating fields will automatically populate after the initial entry.

If you encounter any challenges, utilize the Wizard Tool. You will see some suggestions for easier submission.

Always remember to include the filing date.

Create your personalized e-signature once and insert it in the designated spots.

Review the information you have entered. Rectify errors if necessary.

Click on Done to complete modifications and select the method for delivery. You will find options to use virtual fax, USPS, or email.

You can also download the file for later printing or upload it to cloud storage.

How to Modify Get CA FTB 592-V 2017: Personalize Forms Online

Your swiftly adjustable and adaptable Get CA FTB 592-V 2017 template is at your fingertips. Utilize our collection with an integrated online editor.

Do you delay preparing Get CA FTB 592-V 2017 because you simply don’t know where to start and how to move forward? We empathize with your situation and offer an excellent solution for you that is not related to overcoming your procrastination!

Our online repository of ready-to-edit templates allows you to explore and select from countless fillable forms tailored for various use cases and scenarios. Yet acquiring the file is merely the beginning. We provide you with all the essential tools to complete, sign, and alter the document of your choice directly from our website.

All you have to do is access the document in the editor. Review the wording of Get CA FTB 592-V 2017 and verify if it meets your expectations. Start filling out the template using the annotation features to give your document a more structured and cleaner appearance.

In conclusion, along with Get CA FTB 592-V 2017, you’ll receive:

With our professional option, your finalized forms are generally legally binding and fully encrypted. We ensure the protection of your most sensitive information.

Acquire what is essential to develop a professional-looking Get CA FTB 592-V 2017. Make the right decision and explore our service now!

- Incorporate checkmarks, circles, arrows, and lines.

- Emphasize, black out, and amend the existing text.

- If the document is intended for other users as well, you can insert fillable fields and distribute them for others to complete.

- Once you’ve finished completing the template, you can obtain the document in any accessible format or select from various sharing or delivery options.

- A robust set of editing and annotation tools.

- An integrated legally-binding eSignature functionality.

- The capacity to create forms from scratch or based on the pre-uploaded template.

- Compatibility with multiple platforms and devices for enhanced convenience.

- Various options for securing your files.

- A range of delivery options for simplified sharing and dispatching of files.

- Adherence to eSignature frameworks governing the use of eSignature in online transactions.

Get form

Related links form

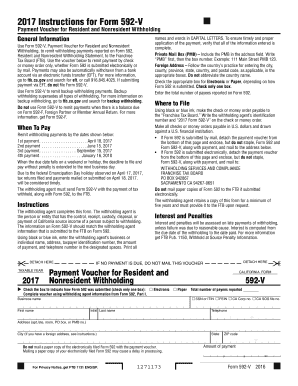

The primary difference between 592-V and 592 Q lies in their purpose and usage. The CA FTB 592-V is specifically for reporting the amount withheld on payments to non-residents, while Form 592 Q assists in reporting the annual withholding amount. Each form plays a vital role in ensuring compliance with California’s tax laws, so it's crucial to choose the correct form based on your withholding needs.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.