Loading

Get Mn Dor M1prx 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR M1PRX online

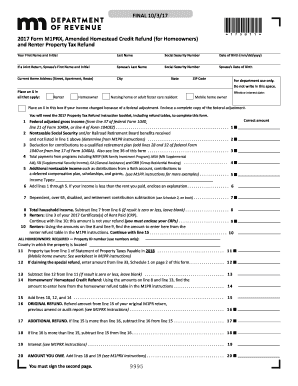

Filing the MN DoR M1PRX online is a straightforward process that allows homeowners and renters to amend their property tax refund applications. This guide provides step-by-step instructions to help you accurately complete the form and ensure your submission is processed efficiently.

Follow the steps to successfully complete your MN DoR M1PRX online.

- Click ‘Get Form’ button to access the MN DoR M1PRX form and open it in the online editor.

- Enter your first name and initial, followed by your last name. Then, provide your social security number and date of birth in the specified format (mm/dd/yyyy).

- If filing jointly, include your spouse’s first name, initial, last name, social security number, and date of birth.

- Input your current home address including street, apartment number (if applicable), city, state, and ZIP code.

- Indicate your status by placing an X in all applicable boxes, including whether you are a renter or homeowner, and if living in a nursing home or adult foster care.

- Complete the income sections by entering your federal adjusted gross income, any nontaxable income, and deductions according to the lines provided in the form.

- If applicable, enter your property ID number and county information for homeowners, and fill in your property tax amounts as specified.

- Provide any necessary additional information for special refunds, along with signatures in designated areas on both pages of the form.

- Review all information for accuracy, then save your changes. You may now download, print, or share the completed form.

Get started today by completing your MN DoR M1PRX online!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When answering whether you are exempt from withholding, you must assess your tax situation thoroughly. If you believe you meet the eligibility requirements, you can respond affirmatively. However, ensure you understand the implications of this status and its impact on your financial planning concerning the MN DoR M1PRX to avoid surprises during tax season.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.