Get Mn Dor M4 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR M4 online

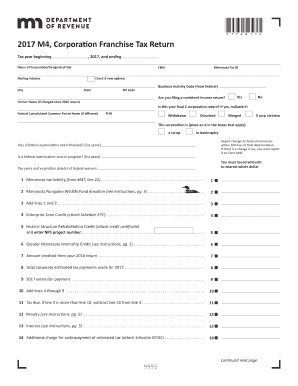

Filling out the Minnesota Department of Revenue M4 corporate franchise tax return can be straightforward with the right guidance. This guide provides step-by-step instructions to assist users in completing the form online efficiently.

Follow the steps to complete the MN DoR M4 form online.

- Click ‘Get Form’ button to access the form and open it in the appropriate editor.

- Enter the tax year information, indicating the start and end dates of the tax year applicable to your corporation.

- Fill in the name of the corporation or designated filer along with the mailing address, including city, state, ZIP code, and relevant identification numbers like FEIN and Minnesota Tax ID.

- Indicate if there has been a change in address, and if the form is a final C corporation return or if the corporation is part of a combined income return.

- If applicable, provide the federal consolidated common parent name and the associated FEIN.

- Complete the sections related to your corporation's tax liability, including calculations for the Minnesota Nongame Wildlife Fund donation, Enterprise Zone Credit, and Historic Structure Rehabilitation Credit.

- Input any additional information required regarding federal examinations and changes to federal income tax.

- Confirm the amounts listed and ensure all calculations are rounded to the nearest whole dollar.

- Review the payment method, selecting either electronic payment or check for any due amounts.

- Finalize the form by providing the authorized signature, title, date, and contact information of the person within the corporation to discuss this return.

- Once the form is fully completed, you can save the changes, download a copy, print it, or share it as necessary.

Start completing your MN DoR M4 form online today and ensure timely submission of your corporation's tax return.

Get form

Related links form

The Revenue Recapture Program helps the state collect outstanding debts owed to various state agencies. Under this program, your tax refund may be used to satisfy past due amounts for items such as child support or student loans. It’s essential to understand how this program works to avoid unexpected situations with your refunds. US Legal Forms can provide additional insights into legal matters related to the program.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.