Get Ca Ftb 590 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 590 online

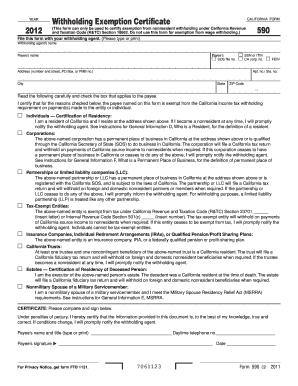

The CA FTB 590, Withholding Exemption Certificate, is an important form used to certify exemptions from nonresident withholding under California law. Completing this form accurately ensures that you can benefit from the necessary tax exemptions. This guide provides step-by-step instructions for filling out the form online.

Follow the steps to complete the CA FTB 590 online.

- Press the ‘Get Form’ button to obtain the form and open it in your editor.

- Fill in the withholding agent’s name at the designated field. Ensure to include any relevant identifiers as needed.

- In the payee’s name section, provide the full legal name of the individual or entity requesting the exemption.

- Enter the payee’s identification information by checking the appropriate box. You may choose to enter their Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), California corporation number, or Federal Employer Identification Number (FEIN).

- Complete the address section by entering the number and street, PO Box or PMB number, and the city, state, and ZIP code.

- Read through the certification statements carefully. Check the box that applies to the payee, whether they are an individual, corporation, partnership or LLC, tax-exempt entity, insurance company, or trust.

- In the certificate section at the bottom of the form, type or print the payee’s name and title, daytime telephone number, sign the form, and include the date.

- Once completed, review the entire form for accuracy. Save your changes and ensure the information is clear and legible.

- You may now download, print, or share the completed form as necessary. Ensure to follow any specific instructions from your withholding agent regarding submission.

Complete your documents online today to ensure efficient tax compliance.

Get form

Related links form

To file an exemption in California, you need to complete the appropriate form, indicating your eligibility for exemption from withholding. This is typically done at the beginning of your tax year or when required. Ensure to keep thorough records for your reasons for exemption, as this will facilitate a smoother process. Don't hesitate to explore US Legal Forms to access the necessary documents and instructions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.