Loading

Get Sc Dor Wh-1605 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR WH-1605 online

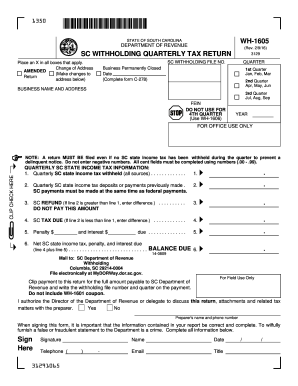

The SC DoR WH-1605 is a quarterly tax return form that businesses in South Carolina must complete to report state income tax withholding. This guide provides a comprehensive and user-friendly approach to filling out the form online, ensuring accuracy and compliance with state regulations.

Follow the steps to complete the SC DoR WH-1605 online

- Click 'Get Form' button to obtain the form and open it in the editor.

- Complete the top of the form with the business name, address, SC withholding file number, and Federal Employer Identification Number (FEIN). Ensure all information is accurate.

- Check the appropriate box to indicate the quarter for which you are filing: 1st, 2nd, or 3rd quarter. Remember, do not use this form for the 4th quarter.

- Fill in the year for which the return is being filed. Make certain this corresponds to the quarterly information provided.

- If applicable, indicate if this is an amended return or if you have a change of address by placing an X in the respective boxes.

- In the 'Quarterly SC State Income Tax Information' section, complete each line with the appropriate values: Line 1 for tax withheld, Line 2 for deposits or payments made, Line 3 for any refunds, Line 4 for tax due, Line 5 for penalty and interest, and Line 6 for the net amount due.

- Review the form for completeness and accuracy. Use black ink only, avoid staples, and ensure all numbers are clearly written without slashes or dollar signs.

- At the bottom of the form, provide your signature, name, and contact information. Indicate your authority to act on behalf of the withholding agent.

- Once you have filled out all sections, save your changes. You may print, download, or share the completed form as needed.

Complete your SC DoR WH-1605 form online today for efficient tax management.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To determine if you qualify for a South Carolina rebate check, you should check your eligibility based on your income tax filings and your filing status. The South Carolina Department of Revenue provides information online to help you understand if you qualify. If eligible, you can expect to receive your rebate check automatically if your tax returns are correctly submitted.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.