Loading

Get Mn Dor Schedule M1c 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR Schedule M1C online

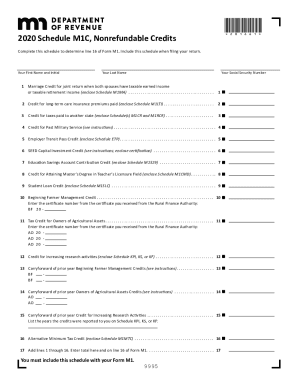

Filling out the MN DoR Schedule M1C is essential for determining nonrefundable credits and ensuring your tax return is accurate. This guide provides step-by-step instructions to help users navigate the online process with ease.

Follow the steps to fill out the MN DoR Schedule M1C online.

- Press the ‘Get Form’ button to access the MN DoR Schedule M1C and open it in the editor.

- Enter your first name and initial in the designated field.

- Input your last name as it appears on your official documents.

- Provide your Social Security number to identify your tax record.

- For line 1, if you qualify for the Marriage Credit, indicate the amount based on Schedule M1MA.

- On line 2, enter the total credit for long-term care insurance premiums, if applicable, and include Schedule M1LTI.

- On line 3, report any credit for taxes paid to another state, if applicable, and attach Schedule M1CR and M1RCR.

- Fill out line 4 for the Credit for Past Military Service, following specific instructions if you qualify.

- For line 5, enter the amount for the Employer Transit Pass Credit, ensuring to enclose Schedule ETP.

- Complete line 6 if you qualify for the SEED Capital Investment Credit, based on the credit certificate from DEED.

- Enter your Education Savings Account Contribution Credit on line 7 and attach Schedule M1529.

- For line 8, if eligible, indicate the credit for attaining a master’s degree in the teacher's field.

- Complete line 9 if you qualify for the Student Loan Credit, and include Schedule M1SLC.

- Fill in line 10 by entering the credit for Beginning Farmer Management Credit, along with the certificate number.

- Provide line 11 information for the Tax Credit for Owners of Agricultural Assets, entering appropriate certificate numbers.

- Complete line 12 if applicable, indicating the Credit for Increasing Research Activities with necessary schedules.

- Summarize any carryforwards on lines 13 to 15 as required.

- Complete line 16 for the Alternative Minimum Tax Credit, ensuring all supporting schedules are attached.

- Finally, sum the total of lines 1 through 16 for line 17, confirming accuracy before proceeding.

- Save your changes, then download, print, or share the completed form as necessary.

Start completing your MN DoR Schedule M1C online today for a seamless tax filing experience!

To qualify for the 2020 credit, all of the following must be true: You are married and filing a joint return. Both you and your spouse have taxable earned income, taxable pensions, or taxable Social Security income. Your joint taxable income is at least $40,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.