Loading

Get Sc Dor Tc-44 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR TC-44 online

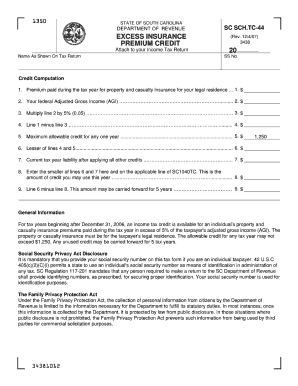

The SC DoR TC-44 form is essential for claiming the excess insurance premium credit in South Carolina. This guide provides clear, step-by-step instructions on how to accurately complete this form online, ensuring you can maximize your tax benefits.

Follow the steps to complete the SC DoR TC-44 form online effectively.

- Select the ‘Get Form’ button to retrieve the SC DoR TC-44 form and open it in your preferred online interface.

- Begin by entering your name exactly as it appears on your tax return in the designated field.

- Input your Social Security number (SSN) in the specified area, as it is necessary for identification purposes.

- Move to the credit computation section. Enter the total amount of property and casualty insurance premiums paid during the tax year for your legal residence in Line 1.

- Next, provide your federal Adjusted Gross Income (AGI) in Line 2 to calculate your credit.

- Calculate 5% of your AGI by multiplying the amount from Line 2 by 0.05 and write the result in Line 3.

- Subtract the amount in Line 3 from Line 1 and record the result in Line 4.

- Enter the maximum allowable credit of $1,250 in Line 5, as this is the annual limit for the credit.

- Identify the lesser amount between Lines 4 and 5 and input this value in Line 6.

- Next, provide your current tax year liability after applying all other credits in Line 7.

- In Line 8, enter the smaller of the amounts on Lines 6 and 7. This is the credit amount you can utilize this year.

- Finally, subtract the amount in Line 8 from Line 6 and indicate the result in Line 9. This amount may be carried forward for up to five years.

- Once all sections of the form are completed, review your entries for accuracy. You can then choose to save your changes, download, print, or share the completed form as needed.

Ensure your eligibility for the excess insurance premium credit by completing the SC DoR TC-44 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You must file SC1040 if you are a resident or part-year resident of South Carolina and your income meets the specified thresholds set by the state. Additionally, if you have any income derived from South Carolina sources, filing is necessary. You can refer to the SC DoR TC-44 for comprehensive guidelines on your requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.