Loading

Get Mn Dor Schedule M1wfc 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR Schedule M1WFC online

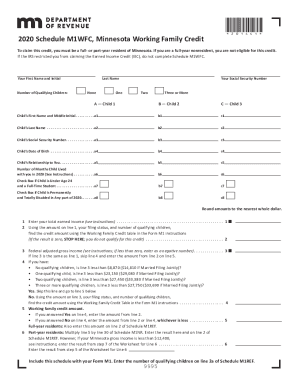

The Minnesota Department of Revenue Schedule M1WFC allows individuals to claim the Minnesota Working Family Credit. This guide provides clear, comprehensive steps for users to complete the form online, ensuring eligibility is met and all necessary information is provided accurately.

Follow the steps to successfully complete the MN DoR Schedule M1WFC online.

- Click ‘Get Form’ button to obtain the document and open it in your preferred format.

- Indicate your first name and initial, followed by your last name. Ensure your details match those on your official identification.

- Input your Social Security Number accurately. This is important for processing your credit claim.

- Select the number of qualifying children you have by checking the appropriate box (None, One, Two, or Three or More). If you have more than three children, only include the first three on the form.

- For each qualifying child, enter their first and last name, social security number, date of birth, and relationship to you in the designated fields. Make sure the information is correct and complete for all children listed.

- Count and enter the number of months that each child lived with you during the year 2020. Follow the specific rules provided in the instructions for accurate reporting.

- Check the respective boxes if a child is a full-time student under age 24 or if they are permanently and totally disabled at any time during 2020.

- Proceed to calculate your total earned income for line 1. Refer to the corresponding worksheet and enter the applicable amount after rounding to the nearest dollar.

- Using the entered earned income, filing status, and number of qualifying children, find your Working Family Credit amount using the provided table in the instructions. If the result on line 2 is zero, you do not qualify for this credit and must stop here.

- If you confirmed eligibility, enter the appropriate amounts on the lines indicated for additional calculations or conditions based on your filing status. Ensure to follow any additional lines or tables provided in the instructions as required.

- Lastly, review all entered information, make any edits as necessary, and save your completed form. You can then download, print, or share the document based on your filing preferences.

Complete your MN DoR Schedule M1WFC online now to claim your credit.

Minnesota Withholding Tax is state income tax you as an employer take out of your employees' wages. You then send this money as deposits to the Minnesota Department of Revenue and file withholding tax returns. Withholding tax applies to almost all payments made to employees for services they provide for your business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.