Loading

Get Mi Form 4884 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Form 4884 online

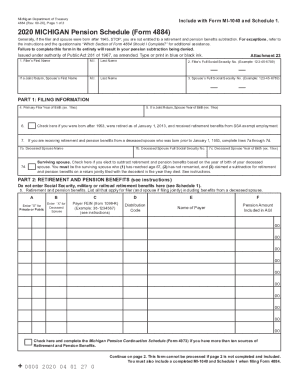

Filling out the MI Form 4884 online is a straightforward process that allows users to claim pension benefits effectively. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to fill out the MI Form 4884 online.

- Click the 'Get Form' button to access the MI Form 4884 and open it in your preferred editor.

- Begin by entering the primary filer's first name, middle initial, and last name in the designated fields.

- Next, provide the filer's full Social Security number in the specified format (Example: 123-45-6789). If filing jointly, repeat this for the spouse's first name, middle initial, last name, and Social Security number.

- In Part 1, enter the year of birth for the primary filer and the spouse if applicable. Be sure to check the box if you were born after 1953, retired as of January 1, 2013, and received retirement benefits from SSA exempt employment.

- If applicable, provide information about any deceased spouse by filling in their name, Social Security number, and year of birth in the sections provided.

- In Part 2, list all retirement and pension benefits received for both the filer and spouse. Indicate the type of benefits by checking the corresponding boxes and include details such as the payer’s FEIN and the pension amount included in AGI.

- Continue to Part 3 to determine which section to complete based on your responses to the questionnaire. Fill out either Section A, B, C, or D, following the prescribed lines for calculations.

- Once all sections have been completed, review your entries for accuracy. Ensure the form is entirely filled out, as incomplete submissions may result in denial of benefits.

- Finally, save your changes. You can then download, print, or share the completed MI Form 4884 as needed.

Complete the MI Form 4884 online today to ensure your pension benefits are processed efficiently.

Related links form

What are Pension and Retirement Benefits (Form. 4884) Under Michigan law, qualifying pension and retirement benefits include most payments that are reported on a 1099-R for federal tax purposes. This includes defined benefit pensions, IRA distributions, and most payments from defined contribution plans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.