Loading

Get Sc Dor Tc-44 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR TC-44 online

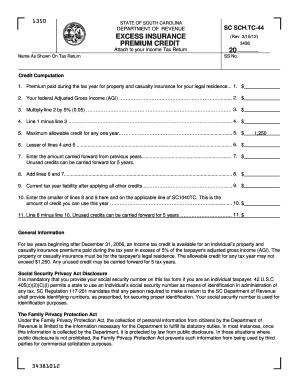

The SC Department of Revenue TC-44 form allows individuals to claim a credit for property and casualty insurance premiums that exceed a certain percentage of their adjusted gross income. This guide provides clear and detailed steps to assist users in completing the form online.

Follow the steps to accurately fill out the SC DoR TC-44 online.

- Click the ‘Get Form’ button to access the SC DoR TC-44 and open it in your chosen online editor.

- In the first section, enter your name as it appears on your income tax return. This ensures that the information is correctly associated with your tax records.

- Next, fill in your social security number in the designated field to comply with identification requirements.

- Proceed to line 1 and input the total premium paid during the tax year for your property and casualty insurance covering your legal residence.

- On line 2, enter your federal adjusted gross income (AGI) for the tax year, which can be found on your tax return.

- Multiply the amount from line 2 by 5% (0.05) and input the result on line 3.

- Subtract the value on line 3 from the value on line 1 and record this amount on line 4 to calculate your preliminary credit.

- Refer to line 5 and note that the maximum allowable credit for one year is $1,250. Record this amount.

- On line 6, enter the lesser amount from either line 4 or line 5. This determines the actual credit you can claim.

- If you have any unused credit carried forward from previous years, record that amount on line 7.

- Add the amounts on lines 6 and 7 and input the total on line 8.

- On line 9, enter your current tax year liability after applying all other credits to determine your eligibility.

- On line 10, write the smaller amount of line 8 and line 9. This is the credit you can use this tax year.

- Finally, subtract the amount on line 10 from line 8 to find any unused credits that may be carried forward for up to five years and record that on line 11.

- After completing the form, ensure all information is filled out accurately. You can then save changes, download, print, or share the completed form as necessary.

Complete your SC DoR TC-44 form online today to take advantage of your credit.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To qualify for in-state tuition in South Carolina, you usually need to establish residency status by living in the state for a specified period. Your financial independence and proof of intent to remain in South Carolina are also considered. The SC DoR TC-44 can guide you through the residency requirements and help you secure favorable tuition rates.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.