Get Sc Dor St-14 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR ST-14 online

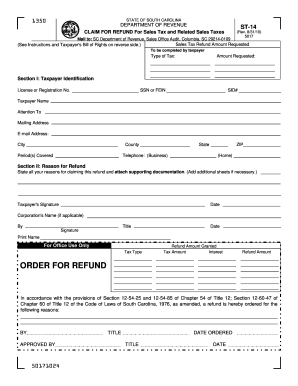

This guide provides clear and detailed instructions on how to complete the South Carolina Department of Revenue SC DoR ST-14 form online. Whether you are a seasoned taxpayer or new to the process, this step-by-step guide will assist you in effectively filling out the necessary fields.

Follow the steps to complete the SC DoR ST-14 online.

- Press the ‘Get Form’ button to obtain the SC DoR ST-14 form and open it for editing.

- In the section labeled 'Sales tax refund amount requested', enter the total amount you are claiming for a refund. Ensure this amount is accurate according to your previous tax filings.

- Complete Section I: Taxpayer Identification. Provide your license or registration number, Social Security Number (SSN) or Federal Employer Identification Number (FEIN), and State Identification Number (SID). Fill in your name, attention to (if necessary), mailing address, email address, city, county, state, telephone number (both business and home), and ZIP code.

- Moving on to Section II: Reason for Refund. Clearly state all reasons for claiming the refund, and if necessary, attach any supporting documentation. You may need additional sheets for detailed explanations.

- Sign and date the form. If applicable, include the corporation's name by providing the title of the person who is signing on behalf of the corporation, along with their printed name and signature.

- Review all entries for accuracy and completeness before proceeding. Make sure all necessary supporting documents are attached.

- Finally, save any changes made to the form. You can then download, print, or share the completed document as needed. Ensure the form is mailed to the SC Department of Revenue at the provided address.

Complete your SC DoR ST-14 form online today for an efficient refund process.

Get form

Getting a US sales tax exemption varies by state, but typically involves completing a form similar to the SC DoR ST-14 for each state where you wish to claim exemption. This form verifies your status as exempt from sales tax based on the specific state’s criteria. You may consider using the resources offered by uslegalforms to navigate the various state requirements effectively. This can save you time and ensure accuracy in your applications.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.