Loading

Get Sc Dor Sc8453 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC8453 online

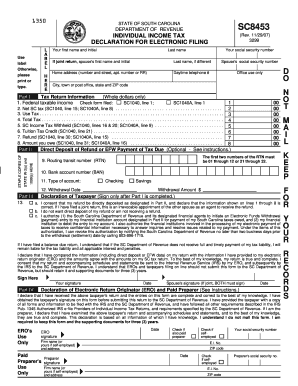

Filling out the SC DoR SC8453 form online is an essential step in submitting your individual income tax return electronically. This guide provides a detailed, step-by-step approach to ensure that you complete the form accurately and efficiently.

Follow the steps to successfully complete the SC DoR SC8453 form.

- Click ‘Get Form’ button to access the SC DoR SC8453 form and open it in your preferred online environment.

- Enter your first name and initial, followed by your last name in the designated fields. Include your social security number to ensure accurate identification.

- If filing a joint return, provide your spouse's first name and initial, last name (if different), and their social security number as instructed.

- Fill in your home address, including the street number, apartment number (if applicable), city, state, and ZIP code.

- Provide a daytime telephone number for any inquiries regarding your submission.

- In Part I, enter the federal taxable income from your SC1040 or SC1040A. Fill in the required amounts for net SC tax, use tax, total tax, SC income tax withheld, and tuition tax credit, ensuring accuracy in whole dollar amounts only.

- Indicate whether you wish to opt for direct deposit for your refund or authorize an electronic funds withdrawal for tax payments by filling in the appropriate fields in Part II. Provide your bank account number and select the account type (checking or savings).

- For the withdrawal date, enter the exact date you wish the transaction to occur. Remember, this date cannot exceed the stipulated deadline to avoid penalties.

- Review your entries carefully and ensure they are correct. In Part III, you must indicate your preferences for direct deposit or EFW and sign where required.

- If applicable, have your spouse sign as well if filing jointly. Next, complete the section for the electronic return originator (ERO) and ensure their signature and details are filled where necessary.

- Once all information is accurately entered, save changes, and download or print your completed form as needed for your records.

Complete your SC DoR SC8453 form online today to ensure timely and efficient processing of your tax return!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain a South Carolina sales tax exemption certificate, you must fill out the appropriate form provided by the SC Department of Revenue. The certificate requires specific information, including your business details and reason for exemption. Once completed, submit it as instructed to the SC DoR SC8453 address. USLegalForms can help you with the forms and provide clarity on the process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.