Loading

Get Mn M15np Additional Charge For Underpayment Of Estimated Tax 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN M15NP Additional Charge For Underpayment Of Estimated Tax online

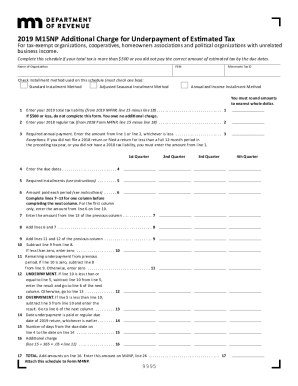

The MN M15NP Additional Charge for Underpayment of Estimated Tax form is essential for tax-exempt organizations, cooperatives, homeowners associations, and political organizations with unrelated business income. This guide provides clear, step-by-step instructions for accurately completing this form online.

Follow the steps to fill out the MN M15NP form online.

- Click the ‘Get Form’ button to download the form and open it in your preferred editor.

- Begin by entering the name of the organization in the designated field. This information identifies the entity completing the form.

- Provide the Federal Employer Identification Number (FEIN) and the Minnesota Tax ID number. Ensure these numbers are accurate, as they are crucial for identification.

- Select the installment method being used by checking one of the boxes provided: Standard Installment Method, Adjusted Seasonal Installment Method, or Annualized Income Installment Method.

- Complete line 1 by entering your 2019 total tax liability, which can be found on line 15 minus line 18 of the 2019 M4NP form. If this amount is $500 or less, do not fill out the rest of the form.

- For line 2, input your 2018 regular tax from the 2018 Form M4NP, line 15 minus line 18.

- On line 3, enter the required annual payment, which is the lesser amount from line 1 or line 2, unless exceptions apply. Review the guidelines on exceptions if applicable.

- List the due dates for your installments in line 4. These dates are typically the 15th of the third, sixth, ninth, and twelfth months of the taxable year.

- Calculate and record the required installments on line 5. Each required installment is generally 25% of the amount on line 3 unless alternative methods are used.

- In line 6, input the amounts you paid for each required installment period. Ensure that payments made after the previous installment due date are recorded accordingly.

- Continue filling out lines 7 through 13 for each installment period. Follow the instructions carefully to perform calculations based on previous lines.

- On line 14, enter the date the underpayment is paid or the regular due date of your 2019 return, whichever comes first.

- Complete line 15 by indicating the number of days from the due date on line 4 to the date entered on line 14.

- Calculate the additional charge on line 16 using the formula provided in the instructions.

- Finally, sum the amounts on line 16 and enter this total on line 17, which should be reported on the M4NP form.

- Once all information has been entered and verified for accuracy, save your changes, and utilize options to download, print, or share the form as needed.

Start filling out your MN M15NP Additional Charge form online today for a seamless tax process.

Related links form

Complete Schedule M15, Underpayment of Estimated Income Tax, to determine your penalty. 5% of the tax not paid prior to the request or $100 (whichever is more). 4% of the tax not paid within 60 days of the assessment date or within 60 days after resolution of an appeal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.