Loading

Get Sc Dor Sc1041 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1041 online

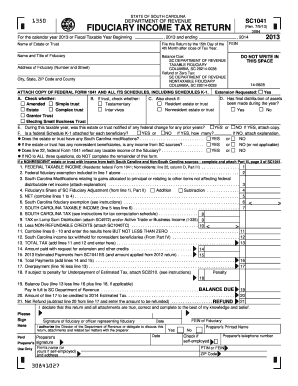

The SC DoR SC1041 form is essential for reporting fiduciary income tax in South Carolina. This guide will assist users in effectively completing the form online, ensuring adherence to all necessary instructions and providing clarity on each section.

Follow the steps to successfully fill out your SC DoR SC1041 online.

- Press the ‘Get Form’ button to access the SC DoR SC1041 form and open it in your preferred online editor.

- Enter the name of the estate or trust in the designated field at the top of the form.

- Fill out the contact information for the fiduciary, including address, city, state, ZIP code, and county.

- Specify the calendar year or fiscal taxable year beginning and ending dates for the estate or trust.

- Indicate if an extension is requested by selecting 'Yes' or 'No' and answer the following questions related to the estate or trust.

- Provide federal taxable income as reflected on federal Form 1041 or appropriate line for nonresidents.

- Complete the modifications relating to South Carolina income, ensuring to attach any necessary explanations or supporting documents.

- Calculate the South Carolina taxable income and follow the instructions for computing tax liability.

- Sign and date the form, ensuring the fiduciary or an authorized officer's signature is present.

- After completing the form, save your changes, download a copy, print it if necessary, or share the completed document as needed.

Complete your SC DoR SC1041 form online today to ensure compliance with South Carolina tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When asked 'Are you exempt from withholding?' on forms like the SC DoR SC1041, you need to assess your tax situation carefully. If you expect to owe no tax due to low income or other circumstances, you may answer yes; otherwise, you would choose no. To ensure clarity on this topic, consult resources offered by US Legal Forms or similar platforms, as they can provide valuable insights.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.