Get Ca Ftb 589 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 589 online

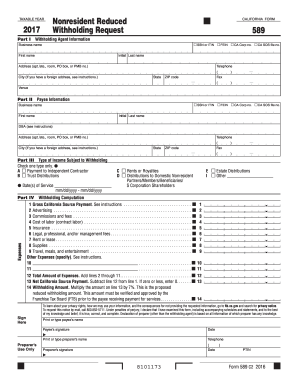

The CA FTB 589 form enables users to request a reduction in the withholding amount for nonresident payments made to individuals or businesses. This guide provides a clear, step-by-step approach to filling out the form online to ensure accurate submissions and compliance with California tax regulations.

Follow the steps to accurately complete the CA FTB 589 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I for withholding agent information. Enter your Taxpayer Identification Number (TIN), business name (or first and last name), address, and phone number. Ensure accurate completion as this identifies you as the payer.

- Move to Part II for payee information. Similarly, provide the necessary TIN and identifying information for the recipient of the payment. Include the Doing Business As (DBA) name if applicable.

- In Part III, select the type of income subject to withholding by checking the appropriate box that corresponds to the payment offered. Indicate the date or range of dates for the service performed.

- Proceed to Part IV and fill in the withholding computation section. Start by entering the gross California source payment on line 1. Then list any direct expenses related to service on lines 2 through 11. Ensure to detail these costs as they reduce the base for withholding.

- Calculate total expenses on line 12, then subtract this amount from the gross payment on line 1 to determine the net California source payment, recorded on line 13.

- Finally, compute the withholding amount by multiplying the net payment (line 13) by 7% for the proposed reduced withholding on line 14. Review all entries for accuracy.

- Sign and date the form in the designated areas for both payee and preparer. Without signatures, the form cannot be processed.

- After reviewing and ensuring that all parts are completed, save your changes. You may then download, print, or share the filled form as needed.

Complete your CA FTB 589 form online to efficiently manage your withholding requests.

Get form

Related links form

In California, various entities and individuals can qualify for tax-exempt status based on specific criteria outlined in the CA FTB 589. Generally, this includes non-profits, certain government organizations, and individuals under particular income thresholds. Familiarize yourself with the requirements to ascertain your eligibility for exemption. US Legal Forms can help you understand these qualifications and navigate related documentation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.