Loading

Get Mi Dot 3799 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 3799 online

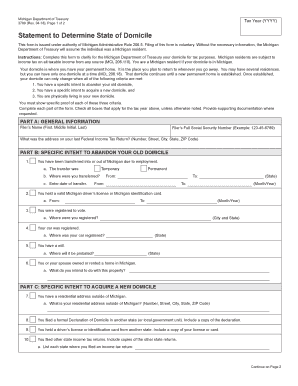

Filling out the MI DoT 3799 form is essential for clarifying your state of domicile for tax purposes in Michigan. This guide will provide you with comprehensive, step-by-step instructions on how to complete the form online effectively.

Follow the steps to successfully fill out the MI DoT 3799 online.

- Click the ‘Get Form’ button to access the MI DoT 3799 form and launch it in your online editor.

- In Part A: General Information, complete the fields for your name and social security number. Also, provide the address stated on your last federal income tax return.

- Move to Part B: Specific Intent to Abandon Your Old Domicile. Answer questions regarding your employment transfer and provide details about your voter registration, will, car registration, and driver’s license.

- Proceed to Part C: Specific Intent to Acquire a New Domicile. Fill in your residential address outside Michigan and any formal declarations of domicile you have filed in another state.

- In Part D: Physically Located in Your New Domicile, indicate if your spouse and dependents have moved to your new location and answer questions about your banking and medical care providers.

- Part E allows you to provide additional information to clarify your answers; use this space wisely.

- In Part F: Statement to Determine State of Domicile, select the applicable box that reflects your current domicile status and provide the date if necessary.

- Finally, review your entries in Part G: Certification and Signature. Sign and date the form to confirm its accuracy.

- Once you have completed the form, save your changes. You may also download, print, or share the completed document as needed.

Start filling out your MI DoT 3799 online today to ensure your domicile is correctly recorded for tax purposes.

Michigan does offer some tax benefits for retirees, including exemptions on certain types of retirement income. However, the overall tax structure still means retirees must navigate some obligations. It's advisable for retirees to invest time in understanding these nuances. For specific guidance on the MI DoT 3799 and retirement tax scenarios, US Legal Forms offers that assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.