Loading

Get Mi Dot 3676 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 3676 online

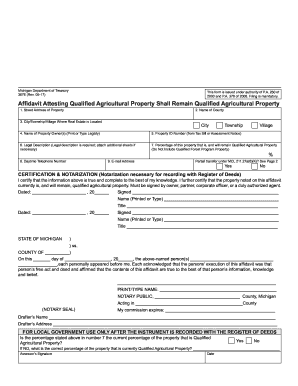

The MI DoT 3676 form is essential for individuals looking to claim that a transfer of qualified agricultural or qualified forest property will maintain its status. This step-by-step guide will assist users in completing the form online with clarity and precision.

Follow the steps to successfully complete the MI DoT 3676 form online.

- Press the ‘Get Form’ button to obtain the MI DoT 3676 form and open it in your preferred editing program.

- In the first field, enter the street address of the property in question.

- Next, indicate the county where the property is located.

- Provide the city, township, or village where the real estate is situated.

- Input the name of the property owner(s) clearly, using either printed text or typing.

- Enter the Property ID Number as found on the tax bill or assessment notice.

- Include a legal description of the property, attaching additional sheets if necessary.

- Specify the percentage of the property that is currently and will remain qualified agricultural property, noting that this step does not apply to the Qualified Forest Program.

- Fill in your daytime telephone number for contact purposes.

- Provide an email address for any correspondence related to the form.

- In the certification section, sign and print your name, including your title. Ensure this is completed by a property owner, partner, corporate officer, or an authorized agent.

- A notary public must also complete the notarization section, including their signature and commission expiration date.

- Finally, save any changes, download the completed form, and print or share it as necessary.

Complete the MI DoT 3676 form online today to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Line 6 of your MI W4 requires you to enter the number of allowances you are claiming. To determine this, refer to the MI DoT 3676, which provides a comprehensive breakdown that helps you evaluate your situation. Accurately entering this number ensures your withholdings are aligned with your tax obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.