Get Ca Ftb 588 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 588 online

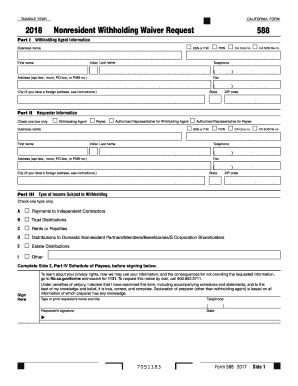

The CA FTB 588 form is essential for individuals and entities engaged in California tax transactions. This guide will help you navigate the process of completing this form online, ensuring accurate submission and compliance with tax regulations.

Follow the steps to complete the CA FTB 588 online accurately.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Review the instructions provided at the top of the form to understand the requirements for filling it out.

- Enter your name or the entity’s name, as applicable, in the designated field. Make sure to use the exact legal name for proper identification.

- Provide your California tax identification number or social security number, ensuring that it is accurate as it is crucial for processing.

- Complete the address section, including street address, city, state, and zip code. Double-check for any typographical errors that could cause issues.

- Fill out the relevant sections that apply to your unique situation, such as income, expenses, or specific tax credits, as instructed in the form.

- Carefully review all the entries for accuracy and completeness before proceeding to the submission section.

- Once satisfied with the information, proceed to save your changes. You may have options to download the form, print a copy, or share it as needed.

Start completing your CA FTB 588 online now to ensure timely and accurate filing.

Get form

Related links form

In California, a fiduciary income tax return must be filed by a fiduciary managing an estate or trust. This return ensures that the income generated from the estate or trust is reported accurately to the state. If the estate or trust has taxable income, you'll use the CA FTB 588 to file the necessary information. Understanding these requirements helps you fulfill your obligations while efficiently managing the estate or trust.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.