Get Mi Dot 3281 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 3281 online

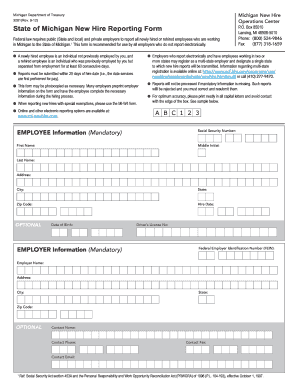

The Michigan Department of Treasury's MI DoT 3281, or the new hire reporting form, is essential for employers to report newly hired or rehired employees in Michigan. This guide provides step-by-step instructions to help users fill out the form online accurately and effectively.

Follow the steps to complete the MI DoT 3281 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering mandatory employee information. Fill in the employee's first name, middle initial, and last name in the designated fields.

- Enter the employee's address, including city, state, and zip code, ensuring all fields are completed.

- Specify the hire date, which is the date the employee first performs services for pay.

- Optionally, fill in the employee’s date of birth and driver's license number, if applicable.

- Next, move to the mandatory employer information section. Enter the Federal Employer Identification Number (FEIN) and employer name.

- Complete the employer's address, including city, state, and zip code.

- Optionally, provide a contact name, contact phone number, contact email, and contact fax number for any inquiries regarding the submission.

- Review all entries for accuracy. Ensure no mandatory information is missing, as incomplete forms will be rejected.

- Save changes to the form, then choose to download, print, or share the form as needed.

Complete the MI DoT 3281 online form today to ensure timely reporting of new hires.

Related links form

To get a Michigan dot number online, visit the Michigan Department of Transportation website to access the necessary application forms. Fill in the required details accurately and submit them electronically along with any required fees. Utilizing platforms like US Legal Forms can help you navigate this process smoothly, ensuring your MI DoT 3281 application is completed correctly and swiftly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.