Loading

Get Al Form P.r-1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL Form P.R-1 online

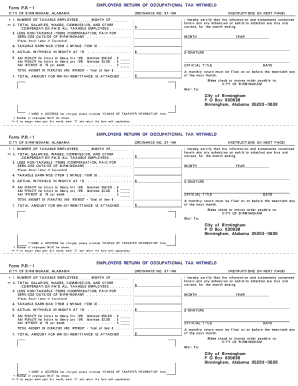

Filling out the AL Form P.R-1 is an essential step for employers in Birmingham, Alabama, to report occupational tax withheld from employees. This guide provides clear, step-by-step instructions on how to complete the form efficiently online.

Follow the steps to complete the AL Form P.R-1.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- In the first section, enter the number of taxable employees for the month indicated. This ensures that the tax calculation is based on the correct employee count.

- For the second item, input the total salaries, wages, commissions, and other compensation paid to all taxable employees during the month. If no payments were made, indicate '0' and return the form with a brief explanation.

- Next, in item three, list any non-taxable items, specifically compensation paid for services rendered outside of Birmingham. Ensure to attach a letter of explanation if applicable.

- For item four, calculate taxable earnings by subtracting the total non-taxable items from the total compensation paid. This amount will be used to assess the occupational tax.

- In item five, enter the amount of tax actually withheld for the month. This should be 1% of the taxable earnings calculated in item four.

- Complete item six by adding any penalties for late filing and payment, as well as interest accrued. Make sure to follow the minimum amounts specified for penalties.

- Finally, in item seven, input the total amount for which remittance is attached, including the total tax and potential penalties.

- Certify the information by signing and dating the form. Include your official title if applicable.

- Review all provided information for accuracy. Once satisfied, save your changes, download the completed form, print it, or share as required.

Complete the AL Form P.R-1 online today to ensure compliance with reporting requirements.

Calculating Alabama state withholding tax involves using the employee's earnings and identifying the correct withholding rates. You will need to reference the Alabama withholding tax tables or use an online calculator to determine the specific amount. Being well-informed when completing the employee withholding certificate form ensures accurate deductions from paychecks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.