Loading

Get Pr 482.0 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 482.0 online

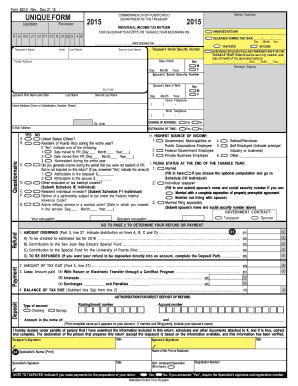

The PR 482.0 form is an essential document for filing an individual income tax return in Puerto Rico. This guide provides a comprehensive overview of how to accurately complete the form online, ensuring that all necessary information is submitted correctly and efficiently.

Follow the steps to complete the PR 482.0 form online.

- Press the ‘Get Form’ button to access the PR 482.0 and open it in your preferred online document editor.

- Enter the taxpayer's name, including the initial and last name, as well as the second last name if applicable. Make sure the name matches exactly with the taxpayer's Social Security records.

- Fill in the taxpayer's Social Security number and the date of birth. Verify these details for accuracy.

- Provide the postal address, including the house number, street name, town or urbanization, and zip code. Ensure that the address is correct and complete.

- Indicate the taxpayer's sex and if applicable, if they were deceased during the year. Also, include the spouse's information if filing jointly.

- Complete the sections regarding income sources, including government employment and self-employment details. Provide accurate figures corresponding to each income category.

- Review all deductions applicable to the taxpayer, completing any additional forms necessary to substantiate the claims.

- Calculate any taxes owed or refunds due based on the fields provided. Ensure that all calculations are correct and align with the latest tax guidelines.

- Sign and date the form where indicated, acknowledging that all information provided is accurate to the best of your knowledge.

- Once all sections are filled, you can save your changes, download the completed form, print it for your records, or share it as necessary.

Complete your PR 482.0 form online now to ensure timely and accurate tax filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In Puerto Rico, several taxes can be exempt, including some local sales taxes and income tax for businesses under certain incentives. These exemptions often depend on the business's activities and residency status. By leveraging PR 482.0, you can position your business to benefit from these exemptions, enhancing your overall profitability and operational viability.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.