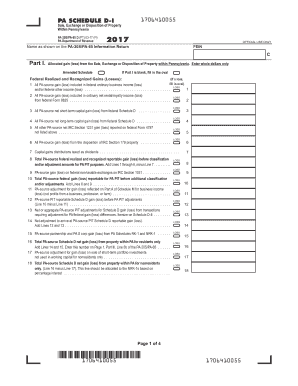

Get Pa Pa-20s/pa-65 D - Schedule D-i 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign PA PA-20S/PA-65 D - Schedule D-I online

How to fill out and sign PA PA-20S/PA-65 D - Schedule D-I online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out a tax document can become a significant barrier and substantial hassle without proper guidance provided.

US Legal Forms is designed as an online solution for PA PA-20S/PA-65 D - Schedule D-I e-filing and offers numerous advantages for taxpayers.

Press the Done button in the upper menu when you have completed it. Save, download, or export the finished template. Use US Legal Forms to ensure a secure and straightforward PA PA-20S/PA-65 D - Schedule D-I completion.

- Locate the template on the website within the relevant section or through the search engine.

- Click the orange button to access it and wait for it to load.

- Examine the blank form and follow the instructions. If you have never filled out the form before, follow the line-by-line guidelines.

- Focus on the highlighted yellow fields. They are fillable and require specific information to be entered. If unsure about what to include, consult the instructions.

- Always sign the PA PA-20S/PA-65 D - Schedule D-I. Utilize the integrated tool to create your electronic signature.

- Select the date field to automatically insert the correct date.

- Review the sample to verify and correct it before submission.

How to modify Get PA PA-20S/PA-65 D - Schedule D-I 2017: personalize forms online

Sign and share Get PA PA-20S/PA-65 D - Schedule D-I 2017 along with any other business and personal documents online without squandering time and resources on printing and postal delivery.

Maximize the benefits of our online form editor with an integrated compliant electronic signature tool.

Authorizing and submitting Get PA PA-20S/PA-65 D - Schedule D-I 2017 templates electronically is quicker and more efficient than handling them on paper. Nevertheless, it necessitates utilizing online solutions that guarantee a high level of data security and furnish you with a certified tool for generating electronic signatures.

Distribute your documentation with others using one of the available options. When authorizing Get PA PA-20S/PA-65 D - Schedule D-I 2017 with our powerful online editor, you can always be confident of obtaining a legally binding and court-admissible document. Prepare and submit documentation in the most effective way possible!

- Our robust online editor is exactly what you require to finish your Get PA PA-20S/PA-65 D - Schedule D-I 2017 and other individual and business or tax forms in an accurate and suitable manner in accordance with all the stipulations.

- It provides all the vital tools to rapidly and effortlessly complete, amend, and endorse paperwork online and incorporate Signature fields for other individuals, indicating who and where should sign.

- It only takes a few straightforward actions to fill out and endorse Get PA PA-20S/PA-65 D - Schedule D-I 2017 online:

- Open the chosen file for further management.

- Utilize the top toolbar to add Text, Initials, Image, Check, and Cross marks to your template.

- Highlight the significant details and redact or remove the sensitive ones if necessary.

- Click on the Sign tool above and choose your preferred method to eSign your document.

- Sketch your signature, type it, upload its image, or use an alternative method that fits you.

- Proceed to the Edit Fillable Fields panel and position Signature fields for others.

- Click on Add Signer and enter your recipient’s email to designate this field to them.

- Confirm that all information provided is complete and accurate before you click Done.

Get form

Related links form

To file an amended PA tax return, you will need to use the PA 40X form. This form allows you to correct errors on your previously filed return. When necessary, include any relevant PA PA-20S/PA-65 D - Schedule D-I information to support your amendments.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.