Get Pa Pa-100 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

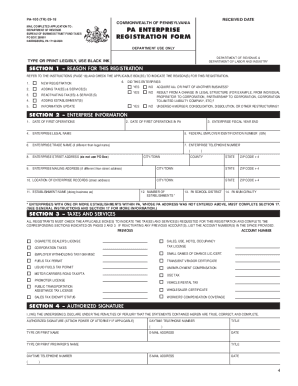

Tips on how to fill out, edit and sign PA PA-100 online

How to fill out and sign PA PA-100 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax forms can escalate into a significant issue and considerable stress without adequate support. US Legal Forms has been created as an online solution for PA PA-100 electronic filing and provides various advantages for taxpayers.

Utilize the following guidelines for completing the PA PA-100:

Leverage US Legal Forms to guarantee secure and straightforward PA PA-100 completion.

- Obtain the blank form from the website in the designated section or through a search engine.

- Click the orange button to access it and wait for it to finish loading.

- Review the form and adhere to the instructions. If you have never filled out this template before, follow the step-by-step instructions provided.

- Pay special attention to the highlighted fields. These are editable and require specific details to be entered. If you are uncertain about what to enter, consult the instructions.

- Always sign the PA PA-100. Use the built-in tool to create your electronic signature.

- Select the date field to automatically insert the correct date.

- Review the form carefully to edit and adjust it before submitting.

- Click the Done button in the top menu once you have completed it.

- Save, download, or export the filled-out form.

How to revise Get PA PA-100 2018: personalize forms online

Bid farewell to an outdated paper-centric method of filling out Get PA PA-100 2018. Have the document completed and verified in moments with our exceptional online editor.

Are you required to alter and finalize Get PA PA-100 2018? With a powerful editor like ours, you can accomplish this in just minutes without needing to print and scan documents repeatedly. We provide entirely customizable and user-friendly document templates that will act as a foundation and assist you in completing the required form online.

All files automatically include fillable fields you can complete as soon as you access the template. However, if you wish to refine the existing content of the form or introduce new information, you can select from a range of customization and annotation tools. Emphasize, obscure, and comment on the document; include checkmarks, lines, text boxes, graphics, notes, and comments. Furthermore, you can easily certify the template with a legally-binding signature. The finalized form can be shared with others, stored, sent to external applications, or converted into any common format.

You won’t go wrong by opting for our online solution to complete Get PA PA-100 2018 because it's:

Don't waste time completing your Get PA PA-100 2018 in the outdated manner - with pen and paper. Use our feature-rich solution instead. It provides you with a comprehensive set of editing tools, integrated eSignature capabilities, and user-friendliness. What distinguishes it from comparable alternatives is the team collaboration features - you can work together on forms with anyone, create a well-structured document approval workflow from start to finish, and much more. Try our online tool and get the best value for your investment!

- Simple to set up and utilize, even for individuals who haven’t handled the paperwork online before.

- Strong enough to meet diverse modification needs and document types.

- Safe and secure, ensuring your editing experience remains protected each time.

- Accessible across various operating systems, allowing for effortless completion of the document from any location.

- Capable of producing forms based on pre-designed templates.

- Compatible with various document formats: PDF, DOC, DOCX, PPT, and JPEG etc.

Related links form

The PA state withholding requirement mandates employers to withhold a flat rate of 3.07% from employees' wages. This withholding is a crucial part of ensuring that state tax obligations are met. When in doubt, refer to the PA PA-100 for accurate information on withholding requirements and practices.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.