Loading

Get Pa Itr-1 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

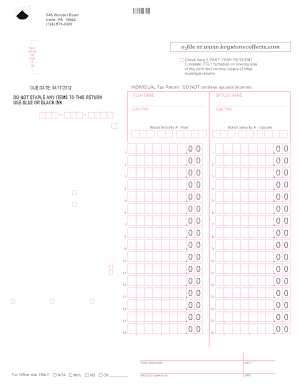

How to fill out the PA ITR-1 online

Filing your earned income tax return is an essential step in managing your financial obligations. This guide provides clear instructions on how to fill out the PA ITR-1 form online, ensuring a smooth and compliant filing process.

Follow the steps to complete your PA ITR-1 form online.

- Press the ‘Get Form’ button to access the form and open it in the designated editor. This will allow you to begin filling out your tax return.

- Enter your personal information, including your name, address, and daytime phone number. Ensure this information is accurate, as it will be used for all correspondence regarding your return.

- Indicate if you are a part-year resident by checking the appropriate box and complete the ITR-1 Schedule on the reverse side if applicable.

- Enter your gross state earnings as reported on your W-2 or 1099 forms in Line 1. Remember to enclose copies of these forms with your submission.

- Document any unreimbursed employee business expenses on Line 2. Be sure to include the PA Schedule UE as an enclosure to support these claims.

- Calculate your taxable earnings by subtracting Line 2 from Line 1 and write the result on Line 3.

- For self-employed individuals, report net profit from business or farm activities on Line 4. Submit the necessary schedules like PA Schedule C, F, RK-1, or 20-S as required.

- If you experienced a net loss from business, report this on Line 5 and include the relevant schedules. Indicate if there are non-deductible S-Corp losses by checking the corresponding box.

- Add the results from Lines 3 and 6 for total earned income and profits on Line 7.

- Calculate your resident tax by multiplying the total from Line 7 with the applicable tax rate, and enter this on Line 8.

- Claim any credits for earned income tax withheld on Line 9 according to the information provided on your W-2. Follow the instructions for this line carefully.

- Include any estimated payments or credits received on Line 10.

- Report any miscellaneous credits on Line 11, including out-of-state or Philadelphia credits, by checking the respective boxes.

- Add Lines 9, 10, and 11 to get the total on Line 12.

- If applicable, calculate the refund or credit on Line 13 by subtracting Line 8 from Line 12. Indicate your preference for applying the refund.

- If there is a tax due, report it on Line 14. Skip this step if the amount is less than $1.00.

- Calculate any penalties or interest that apply using Lines 15 and 16, then total these on Line 17.

- Carefully review all entries to ensure accuracy. Once confirmed, save your changes, and then download or print the completed form for submission.

Start completing your PA ITR-1 form online today to ensure your taxes are filed correctly and on time.

Related links form

Generally, inheritances are not considered taxable income for federal or Pennsylvania state income tax purposes. However, you may still need to report certain elements or file a PA ITR-1 if the estate has tax obligations related to inheritance tax. It's crucial to understand these distinctions, and consulting US Legal Forms can guide you through the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.