Loading

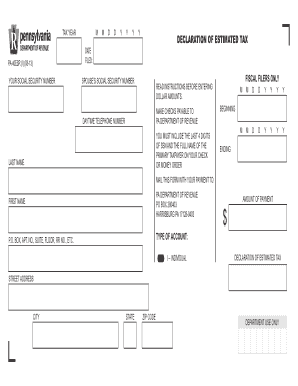

Get Tax Year M M D D Y Y Y Y Declaration Of Estimated Tax Date Filed: Pa-40esr (i) (08-13) Your Social 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TAX YEAR M M D D Y Y Y Y DECLARATION OF ESTIMATED TAX DATE FILED: PA-40ESR (I) (08-13) YOUR SOCIAL online

Filling out the TAX YEAR M M D D Y Y Y Y DECLARATION OF ESTIMATED TAX form is an essential step for taxpayers who need to report their estimated tax. This guide provides clear instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your tax declaration form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your tax year by filling in the fields designated for the month (M M), day (D D), and year (Y Y Y Y). This information is crucial for your tax records.

- Provide your Social Security number and, if applicable, your spouse’s Social Security number. Ensure accuracy to avoid any processing delays.

- If you are a fiscal filer, indicate this clearly in the designated section.

- Input your daytime telephone number for any necessary follow-up regarding your submission.

- Fill in the last name and first name fields to identify the primary taxpayer.

- Enter the amount of payment in the specified area. Ensure that you double-check this figure for correctness.

- Specify the type of account by selecting from the options provided (i.e., individual).

- Complete your address, including street address, city, state, and ZIP code. Make sure the address is accurate as it needs to be visible through the envelope window.

- Review all entered information for accuracy, then proceed to save your changes.

- Once complete, you may have the option to download, print, or share the form for mailing.

Submit your TAX YEAR M M D D Y Y Y Y DECLARATION OF ESTIMATED TAX form online today!

Related links form

To file an estimated tax return, first calculate your expected income and tax liability for the year. Next, complete the appropriate forms, such as the PA-40ESR for the TAX YEAR M M D D Y Y Y Y DECLARATION OF ESTIMATED TAX DATE FILED: PA-40ESR (I) (08-13) YOUR SOCIAL. Finally, submit your form by the designated deadline to avoid penalties, ensuring your financial obligations are met.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.