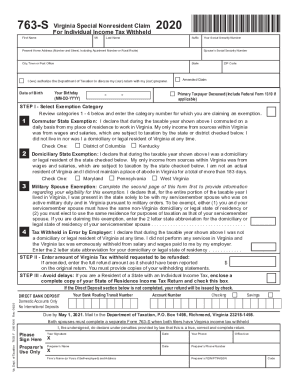

Get Va 763-s 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign VA 763-S online

How to fill out and sign VA 763-S online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Tax form filling out can turn into a significant challenge and serious headache if no correct assistance offered. US Legal Forms has been created as an web-based resolution for VA 763-S e-filing and supplies multiple advantages for the taxpayers.

Utilize the tips on how to fill in the VA 763-S:

-

Obtain the template online within the particular section or via the Search engine.

-

Press the orange button to open it and wait until it?s done.

-

Go through the template and pay attention to the recommendations. If you have never accomplished the sample earlier, follow the line-to-line recommendations.

-

Focus on the yellow-colored fields. They are fillable and demand specific data to get inserted. If you are unclear what info to put in, learn the instructions.

-

Always sign the VA 763-S. Make use of the built-in tool to generate the e-signature.

-

Press the date field to automatically insert the appropriate date.

-

Re-read the template to press and modify it ahead of the submission.

- Push the Done button in the top menu once you have completed it.

-

Save, download or export the completed form.

Use US Legal Forms to ensure comfortable as well as simple VA 763-S completion

How to edit VA 763-S: customize forms online

Fill out and sign your VA 763-S quickly and error-free. Find and edit, and sign customizable form templates in a comfort of a single tab.

Your document workflow can be far more efficient if everything required for editing and managing the flow is arranged in one place. If you are looking for a VA 763-S form sample, this is a place to get it and fill it out without searching for third-party solutions. With this intelligent search engine and editing tool, you won’t need to look any further.

Simply type the name of the VA 763-S or any other form and find the right template. If the sample seems relevant, you can start editing it right on the spot by clicking Get form. No need to print or even download it. Hover and click on the interactive fillable fields to place your details and sign the form in a single editor.

Use more editing tools to customize your template:

- Check interactive checkboxes in forms by clicking on them. Check other areas of the VA 763-S form text with the help of the Cross, Check, and Circle tools

- If you need to insert more textual content into the document, use the Text tool or add fillable fields with the respective button. You may also specify the content of each fillable field.

- Add pictures to forms with the Image button. Add pictures from your device or capture them with your computer camera.

- Add custom visual components to the document. Use Draw, Line, and Arrow tools to draw on the document.

- Draw over the text in the document if you wish to conceal it or stress it. Cover text fragments with theErase and Highlight, or Blackout tool.

- Add custom components like Initials or Date with the respective tools. They will be generated automatically.

- Save the form on your device or convert its format to the one you need.

When equipped with a smart forms catalog and a powerful document editing solution, working with documentation is easier. Find the form you require, fill it out right away, and sign it on the spot without downloading it. Get your paperwork routine simplified with a solution tailored for editing forms.

Get form

Related links form

The big news coming for 2018, stemming from the tax reform bill passed in December, 2017, is the elimination of the standard $4,050 personal tax exemption, while the standard tax deduction doubles in the 2018 tax year. Personal tax exemptions are changing as well, as you'll see below.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.