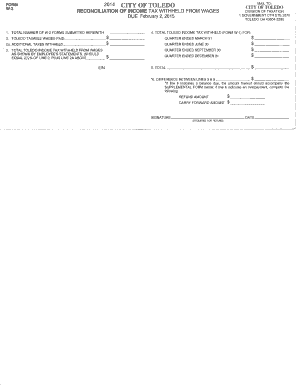

Get Oh W-3 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OH W-3 online

How to fill out and sign OH W-3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax forms can become a significant issue and a considerable hassle if adequate guidance is not provided.

US Legal Forms has been created as an online resource for OH W-3 electronic filing and offers various advantages for taxpayers.

Click the Done button in the top menu once you have finished it. Save, download, or export the completed form. Utilize US Legal Forms to ensure an easy and efficient OH W-3 completion.

- Obtain the blank form online in the appropriate section or through the search engine.

- Press the orange button to access it and wait until it's fully loaded.

- Examine the template and adhere to the guidelines. If you have never filled out the template before, follow the line-by-line instructions.

- Focus on the yellow-highlighted fields. These are fillable and require specific information. If uncertain about what to enter, refer to the instructions.

- Always sign the OH W-3. Use the built-in tool to create the electronic signature.

- Select the date field to automatically input the correct date.

- Re-read the template to review and make changes before submitting.

How to Modify Get OH W-3 2014: Personalize Forms Online

Utilize our extensive editor to convert a basic online template into a finalized document. Continue reading to discover how to change Get OH W-3 2014 online effortlessly.

Once you locate an ideal Get OH W-3 2014, all you need to do is modify the template to suit your preferences or legal stipulations. Besides completing the fillable form with precise information, you may desire to eliminate some provisions in the document that are unrelated to your situation. Alternatively, you might want to incorporate some absent conditions in the original template. Our sophisticated document editing tools are the easiest means to rectify and modify the form.

The editor allows you to alter the content of any form, even if the document is in PDF format. You can add and delete text, insert fillable fields, and make additional adjustments while preserving the original formatting of the document. You may also reorganize the structure of the document by modifying the page sequence.

You don’t need to print the Get OH W-3 2014 to sign it. The editor includes electronic signature functionality. Most forms already have signature fields. Therefore, you simply need to append your signature and request one from the other signing party with just a few clicks.

Follow this detailed guide to produce your Get OH W-3 2014:

After all parties finalize the document, you will receive a signed copy that you can download, print, and share with others.

Our solutions allow you to save a significant amount of time and reduce the likelihood of errors in your documents. Enhance your document workflows with efficient editing tools and a robust eSignature solution.

- Open the selected template.

- Use the toolbar to modify the template to your preferences.

- Complete the form with accurate information.

- Click on the signature field and append your eSignature.

- Send the document for signature to other signatories if required.

Get form

Choosing between 1 or 0 for your tax withholding in Ohio depends primarily on your personal circumstances. If you are unsure, opting for 0 may lead to a higher amount withheld, potentially resulting in a tax refund. However, if you have additional deductions, claiming 1 could balance your paycheck without owing too much at the end of the year. It’s wise to analyze your financial situation and fill out your OH W-3 accordingly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.