Get De Wcwt-5 - Wilmington 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE WCWT-5 - Wilmington online

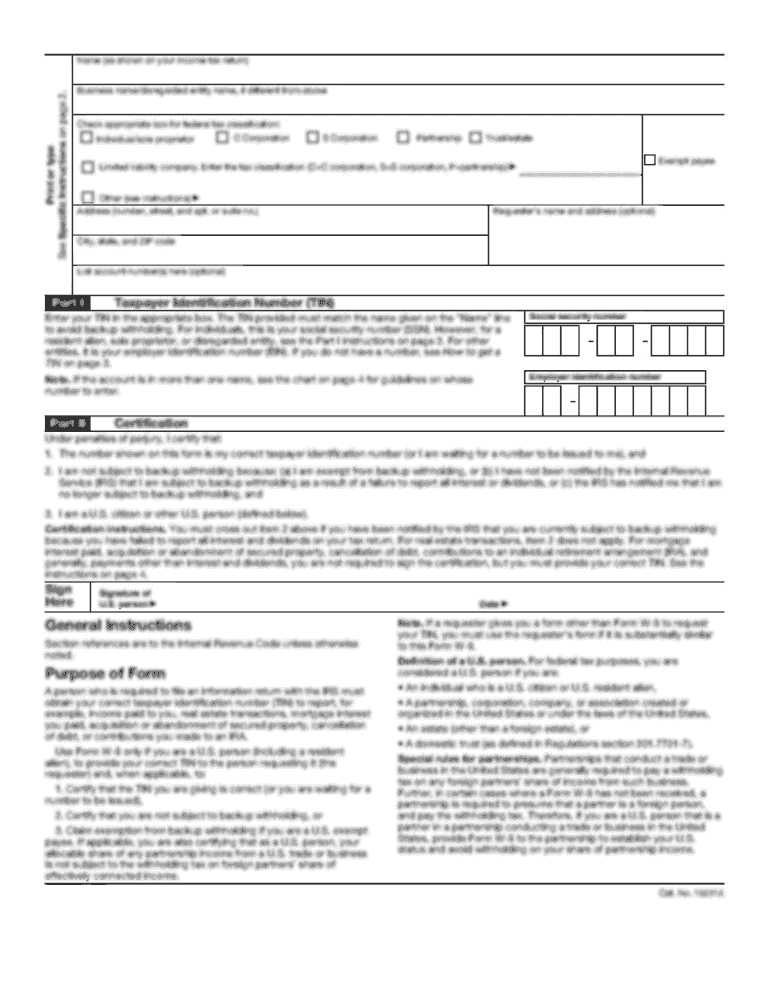

The DE WCWT-5 is a crucial form for individuals seeking a refund of Wilmington city wage tax. This guide will provide clear and supportive instructions on how to fill out the form online, ensuring that all necessary information is accurately captured.

Follow the steps to complete your DE WCWT-5 form online effectively.

- Click ‘Get Form’ button to access the DE WCWT-5 form and open it for completion.

- Begin by entering your personal background information in Section 1. This includes your name, home address, and employment details. Ensure that you provide complete and accurate information.

- Attach a copy of your W-2 that shows both federal and local wages as instructed. This document is necessary for your refund processing.

- Obtain an authorized signature from your employer. Make sure to follow the requirement for employer certification to validate your claims.

- Complete the refund computation in Section 2. Provide your gross earnings, overtime information, and other necessary calculations to determine your tax refund amount.

- Fill out the dates worked outside the city chronologically and clearly identify locations. Ensure to follow the required format as specified.

- Complete the non-working days section, listing only holidays, vacation, and illness in chronological order.

- Final calculations: Confirm that all totals are accurate, including the allocation percentage, and calculate the net refund or amount due based on the provided formulas.

- Review the completed form carefully for accuracy before signing it. Ensure all necessary fields are filled out and attachments included.

- Once satisfied, save your changes, download a copy of the form, and share it as needed. Ensure it is mailed to the correct address for processing.

Complete your DE WCWT-5 form online today to secure your tax refund efficiently.

Get form

The city wage tax in Wilmington is a percentage of the earnings of residents and those working within the city. This tax falls under the DE WCWT-5 - Wilmington, with the funds supporting local government operations. Employers typically withhold this tax from employee paychecks, making it easier for residents to comply with tax regulations. For accurate wage tax rates, individuals should consult their payroll department or the city’s tax authority.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.