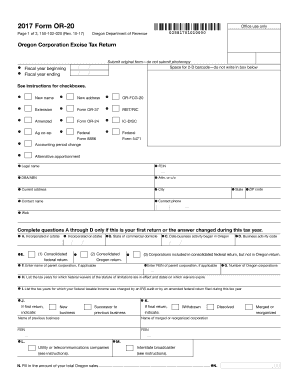

Get Or Or-20 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OR OR-20 online

How to fill out and sign OR OR-20 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out the tax form can turn into a considerable obstacle and a significant annoyance if no suitable support is provided.

US Legal Forms is designed as an online solution for OR OR-20 e-filing and presents numerous benefits for taxpayers.

Use US Legal Forms to ensure an easy and straightforward OR OR-20 completion.

- Obtain the form online in the appropriate section or through the search engine.

- Click the orange button to access it and wait for it to load.

- Examine the form and adhere to the guidelines. If you haven't filled out the template before, follow the step-by-step instructions.

- Focus on the highlighted fields. They are interactive and require specific information to be entered. If you're uncertain about what to input, refer to the instructions.

- Always sign the OR OR-20. Use the built-in tool to create an electronic signature.

- Tap the date field to automatically fill in the correct date.

- Review the document to verify and modify it before submission.

- Press the Done button in the upper menu once you have finalized it.

- Save, download, or export the completed form.

How to revise Get OR OR-20 2017: personalize forms online

Authorize and distribute Get OR OR-20 2017 along with any other commercial and personal documents online without wasting time and resources on printing and postal delivery. Maximize the benefits of our web-based form editor equipped with a built-in compliant eSignature feature.

Authorizing and submitting Get OR OR-20 2017 templates electronically is quicker and more efficient than managing them on paper. Nevertheless, it necessitates the use of online solutions that guarantee a high degree of data security and offer you a certified tool for creating electronic signatures. Our robust online editor is exactly what you require to prepare your Get OR OR-20 2017 and other personal and business or tax forms accurately and appropriately following all regulations. It provides all the essential tools to conveniently and swiftly complete, modify, and sign documents online and add signature areas for additional individuals, indicating who and where needs to sign.

It requires only a few straightforward steps to complete and sign Get OR OR-20 2017 online:

Share your document with others using one of the available methods. When authorizing Get OR OR-20 2017 with our effective online editor, you can always trust that it becomes legally binding and court-admissible. Prepare and submit paperwork in the most efficient manner possible!

- Open the chosen file for further editing.

- Use the upper toolbar to insert Text, Initials, Image, Check, and Cross marks into your template.

- Highlight the crucial information and blackout or eliminate the sensitive ones if needed.

- Click on the Sign tool above and choose how you wish to eSign your document.

- Sketch your signature, type it, upload an image of it, or select another option that suits you.

- Switch to the Edit Fillable Fields panel and drop Signature areas for other parties.

- Click on Add Signer and input your recipient’s email to assign this field to them.

- Ensure that all provided information is thorough and correct before clicking Done.

Get form

The 200-day rule in Oregon refers to a residency requirement for individuals moving to the state and seeking tax benefits. Under this rule, if you spend more than 200 days in Oregon during a tax year, you may need to file an Oregon income tax return. This rule is crucial for understanding tax obligations, especially when filling out the OR OR-20 and related forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.