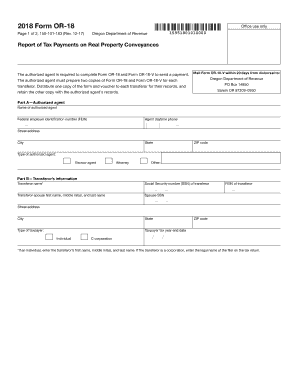

Get Or Or-18 Tpv-18 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OR OR-18 TPV-18 online

How to fill out and sign OR OR-18 TPV-18 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax documents can become a major challenge and a serious nuisance without appropriate assistance provided.

US Legal Forms is designed as an online resource for OR OR-18 TPV-18 e-filing and offers numerous advantages for taxpayers.

Use US Legal Forms to ensure secure and straightforward OR OR-18 TPV-18 completion.

- Obtain the template from the website in the designated section or through a search engine.

- Press the orange button to open it and wait for the process to finish.

- Examine the template and pay close attention to the guidelines. If you've never filled out the template before, adhere to the step-by-step instructions.

- Focus on the highlighted fields. They are editable and require specific information to be entered. If you're uncertain about what information to provide, consult the guidelines.

- Always sign the OR OR-18 TPV-18. Utilize the built-in tool to create the electronic signature.

- Select the date field to automatically insert the correct date.

- Review the template to make any necessary changes before submission.

- Click the Done button in the upper menu once you have completed it.

- Save, download, or export the filled-out form.

How to modify Get OR OR-18 TPV-18 2018: personalize forms online

Put the right document management resources at your command. Execute Get OR OR-18 TPV-18 2018 with our trustworthy service that includes editing and eSignature features.

If you wish to finish and validate Get OR OR-18 TPV-18 2018 online without any hassle, then our online cloud-based choice is the perfect solution. We offer a comprehensive template-based library of ready-to-use forms that you can adapt and complete online.

Additionally, you don't have to print out the form or rely on third-party applications to make it fillable. All essential functionalities will be available to you as soon as you access the file in the editor.

The main toolbar includes features that help you emphasize and conceal text, excluding images and graphic elements (lines, arrows, checkmarks, etc.), sign, initialize, date the document, and more.

Utilize the left toolbar if you wish to reorder the document or eliminate pages.

If you want to create the document fillable for others and share it, you can use the tools on the right to add various fillable fields, signatures, dates, text boxes, etc. Besides the aforementioned functionalities, you can safeguard your document with a password, add a watermark, convert the file to the required format, and much more.

- Examine our online editing utilities and their primary functionalities.

- The editor features an intuitive interface, so it won't take long to learn how to use it.

- We’ll explore three key areas that enable you to:

- Edit and annotate the template

- Organize your documents

- Prepare them for distribution

Related links form

The amount you put for withholding allowance should reflect your personal tax situation and financial needs. You can estimate this by reviewing your previous tax returns, and considering factors like dependents, additional income, and deductions. For clarity and assistance, you can utilize tools from US Legal Forms, which offer insights into optimizing forms such as OR OR-18 TPV-18.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.