Get Or Form Or-tm 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR Form OR-TM online

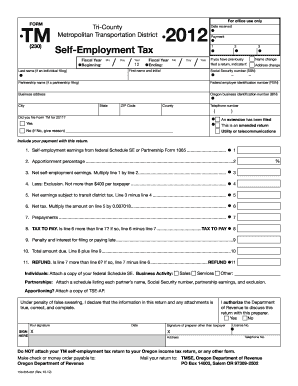

Filling out the OR Form OR-TM online is a straightforward process that ensures compliance with the Tri-County Metropolitan Transportation District self-employment tax. This guide will provide you with clear, step-by-step instructions tailored for users of all experience levels.

Follow the steps to complete your OR Form OR-TM online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal details in the name and address section. Include your full name, business address, and daytime telephone number along with your Social Security number (SSN).

- Report your self-employment earnings by filling in the amount from your federal Schedule SE or Partnership Form 1065 on line 1.

- If your business activity is carried out both inside and outside the TriMet District, calculate the apportionment percentage and enter it in line 2.

- On line 4, enter your exclusion amount, which cannot exceed $400, based on your earnings reported.

- Calculate your net self-employment earnings for taxation in line 5 by subtracting the exclusion from your reported earnings.

- Determine the tax to pay on line 8 by multiplying the net self-employment earnings by the tax rate of 0.007018.

- Fill out any prepayments you have made for TriMet self-employment tax on line 7, and calculate any penalties and interest for late submission on line 9.

- Finalize your return by adding the amounts on lines 8 and 9 to calculate the total amount due on line 10.

- Before submission, ensure you sign and date your return. Do not attach it to your Oregon income tax return. Save your changes, then download, print, or share the completed form as needed.

Complete your OR Form OR-TM online today to ensure compliance with the TriMet self-employment tax.

Get form

Related links form

You can make a payment to the Oregon Department of Revenue online, by mail, or through authorized payment processors. The online portal allows for quick and easy transactions, including payments related to your form OR-TM. Just select the appropriate payment option that suits your needs. Remember to keep a record of your payment confirmation, as it can help with your tax reconciliation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.