Loading

Get Or 40x 2004-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR 40X online

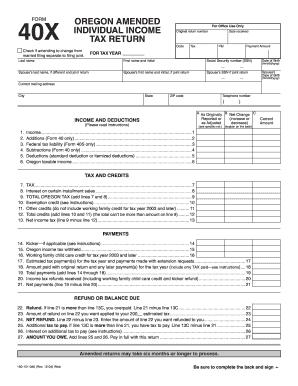

Filling out the OR 40X form is an essential step for individuals looking to amend their Oregon individual income tax return. This guide will provide clear instructions to help users navigate through each section effectively.

Follow the steps to complete the OR 40X form online.

- Press the 'Get Form' button to obtain the OR 40X form and open it for editing.

- Begin by filling in your personal information. Enter your last name, first name, and middle initial. Ensure you also provide your Social Security number in the designated field.

- If you are filing a joint return, include your spouse's last name, first name, and Social Security number. Provide their date of birth as well.

- Specify the tax year for which you are amending the return in the indicated space.

- Next, move to the 'Income and Deductions' section. Carefully report the original amounts or adjustments for each item listed, including income, additions, subtractions, and deductions. Ensure accuracy as these figures will influence your tax calculation.

- Continue to the 'Tax and Credits' section. Here, compute your tax based on the income and deductions you've entered. Don't forget to include any applicable credits.

- In the 'Payments' section, document any estimated tax payments you have made and any taxes withheld. This information is crucial for determining if you have a balance due or if you will receive a refund.

- Review the 'Refund or Balance Due' section. Calculate your total refund or the amount you owe, ensuring all calculations are correct.

- Once all sections are completed, ensure to explain any adjustments made in detail, using the space provided on the back of the form.

- Finally, sign and date the form. If filing jointly, your spouse should also sign. Save your changes, and if you wish, download, print, or share the completed form.

Complete your OR 40X form online today for a smooth filing process!

Yes, you may still need to file taxes even if you only earned $5000, especially if it exceeds the minimum threshold set by the KRA. Filing ensures you remain compliant and may even allow you to access potential deductions or refunds. Always check the latest guidelines or consider tools like OR 40X to assist in understanding your obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.